| Q1 • 2022 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Market Data

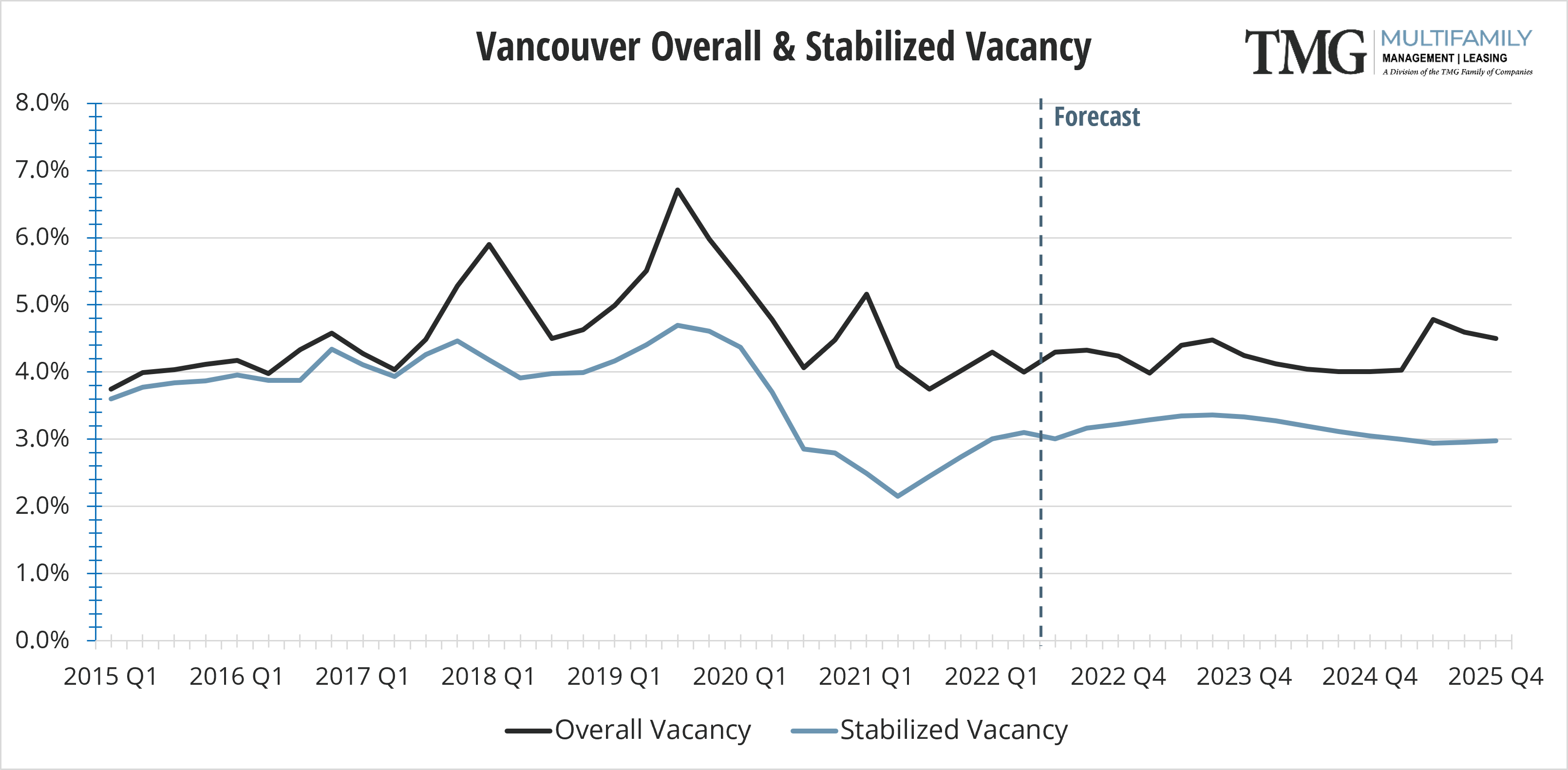

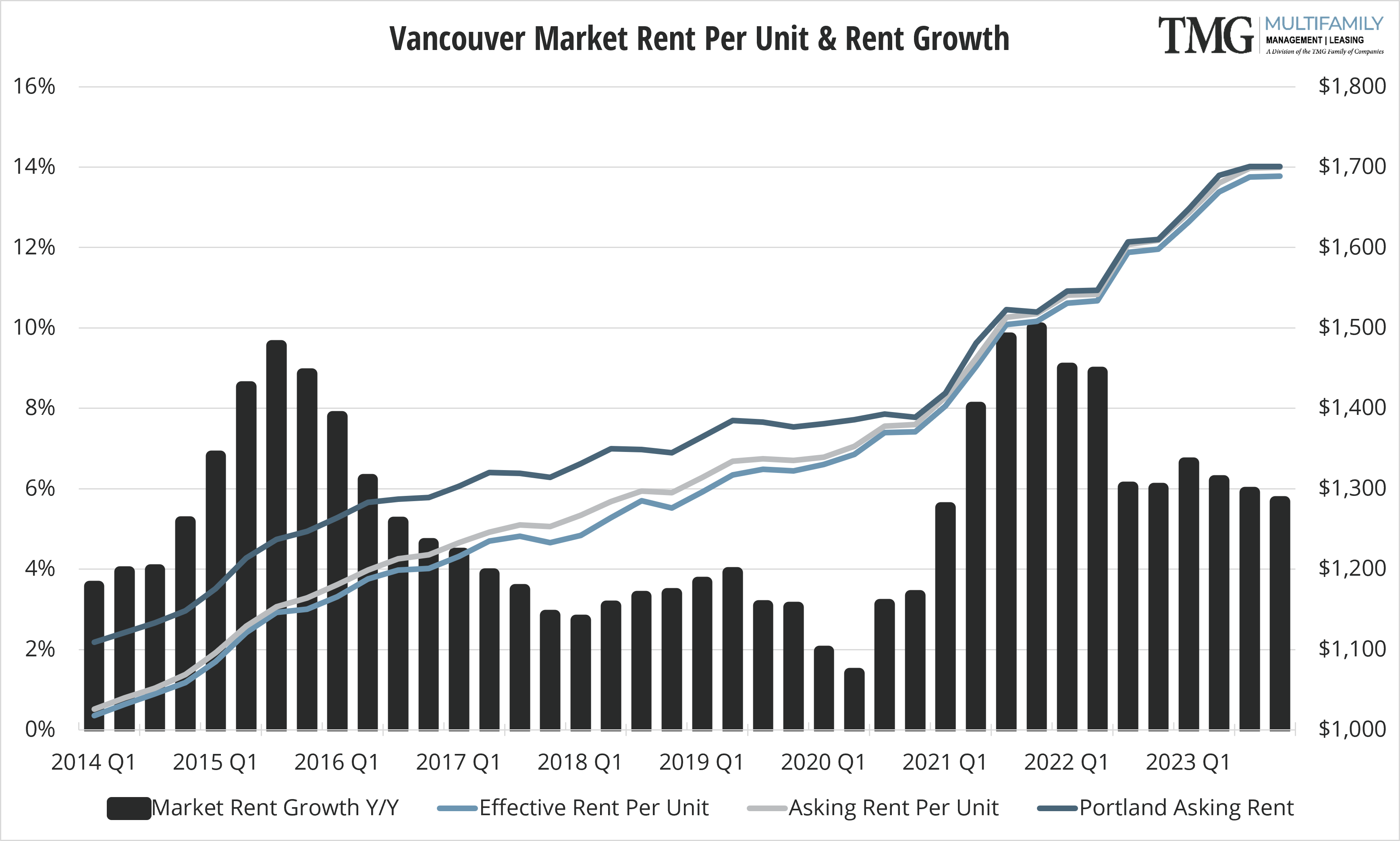

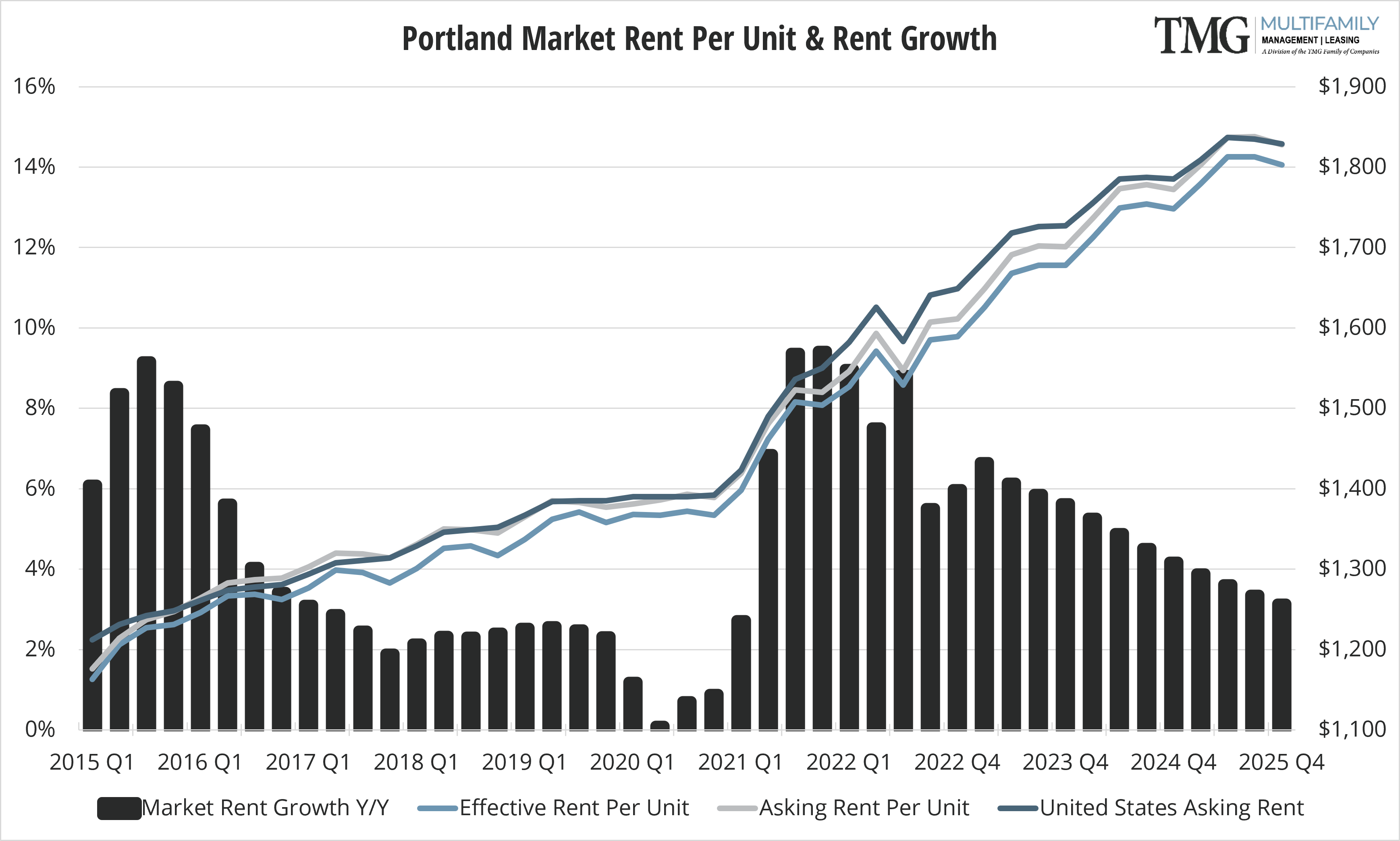

Inflation and the Multifamily Market in the PNW. While the economy is growing, inflation has become an increasing concern, averaging more than 5% year over year (YoY) each month since late spring 2021. In the month of November 2021, inflation grew a staggering 6.8%, which is the highest inflation rate seen in nearly 40 years! Given the robust demand for housing so far this year, it appears that upward price pressure for both rental and for-sale housing will continue as overall housing shortages escalate in the Pacific NW. There are multiple pricing pressures on for sale housing; new regulations for energy efficiency, supply chain delivery issues, overall product availability and finally the increase in mortgage rates. These pressures will drive even more potential homeowners into the rental housing market and the results will be decreased availability followed by a continuing escalation in rental rates.

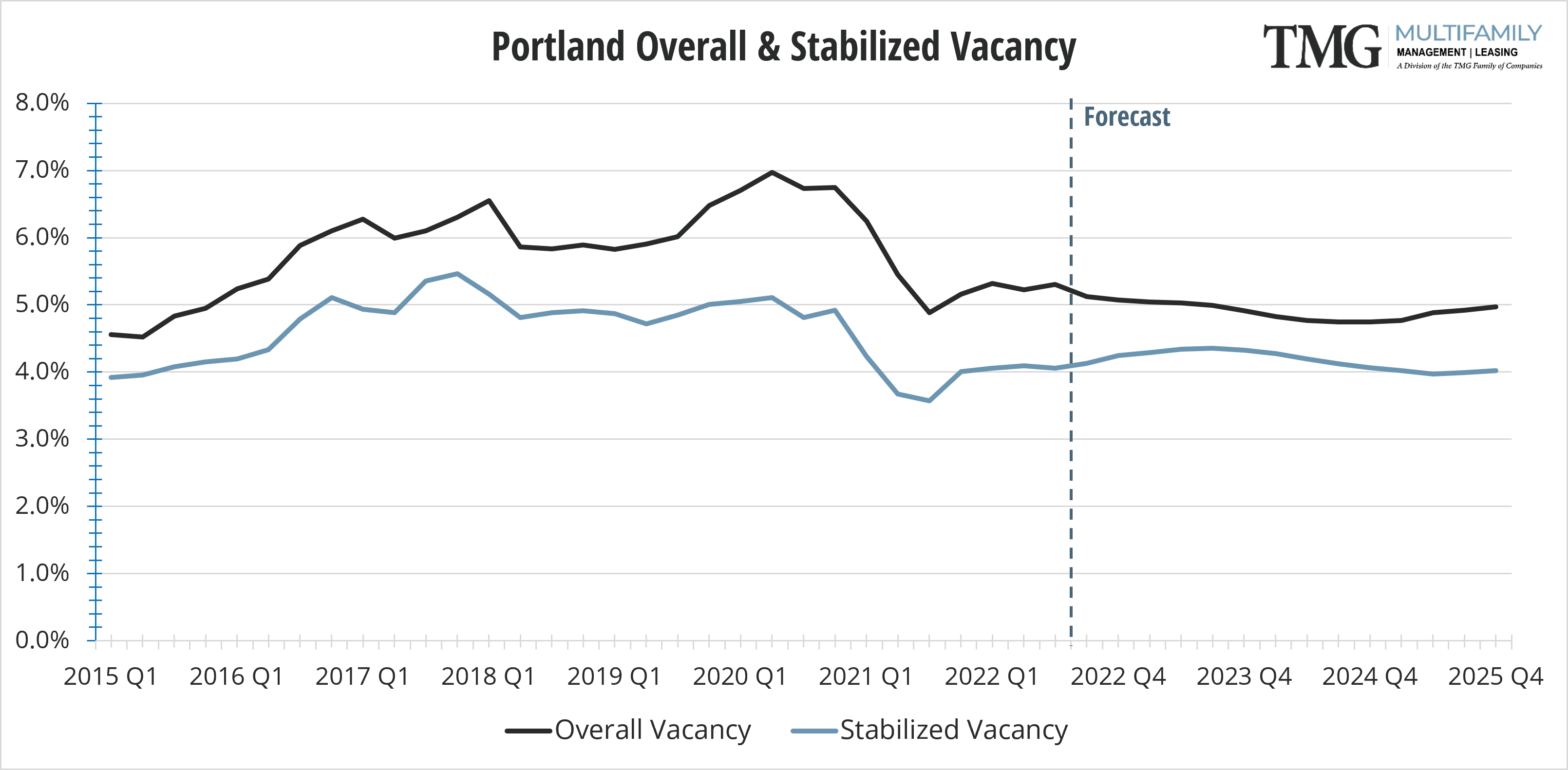

New trends are emerging. During the early days of the pandemic, many tenants fled expensive, densely populated, urban city centers for less expensive and less dense suburban locations. In late 2021, many of these urban markets have started to rebound. Portland is one of those markets beginning to rebound, however, the continuing political atmosphere and increasing crime have prevented the city’s urban core occupancy from trending upward as quickly as other city centers. New trends in rental criteria are also emerging; the ”3x the rent income standard” has given away to 2.5 or 2x the rent as the new income standard. Wages have increased but not as quickly as rental rates. Increased delinquency due to a lessening of the income criteria has not materialized, likely due to the eviction moratorium regulations and timelines drop dropping off.

Looking Ahead. While inflation is affecting physical property expenses as well as onsite wages, driving up overall expenses, the unprecedented levels of demand for multifamily housing continues to increase revenue, creating robust apartment market projections through 2023.

Washington: Washington’s rent collection process has been a complicated and ever-changing matter since the eviction moratorium expired on October 31, 2021. The Eviction Resolution Program (ERP) which is running through the “Dispute Resolution Center” or “DRC”, is not only a requirement for tenants with unpaid rent from during the eviction moratorium, but a requirement for new balances that occur until July 2023. The DRC must issue a “certificate” that allows us to file for eviction only after we have met all the legal requirements of a nonpayment of rent notice. The aide of our attorneys has been critical throughout this process to advocate for our rights as landlords.

Oregon: As of March 1, 2022, landlords were allowed to send termination notices to tenants who had remaining balances from the “emergency period” (4/1/2020-6/30/2021). The Oregon Emergency Rental Assistance Program (OERAP) has provided rental assistance to tenants in need of back owed balances. The program has been open to applicants for the last nine months and TMG has continued to encourage tenants in need to apply. The OERAP officially closed on March 21, 2022 and, as of March 1, 2022, tenants with a balance that had not yet shown proof of application to the OERAP received a termination notice.

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar