| Q2 • 2023 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

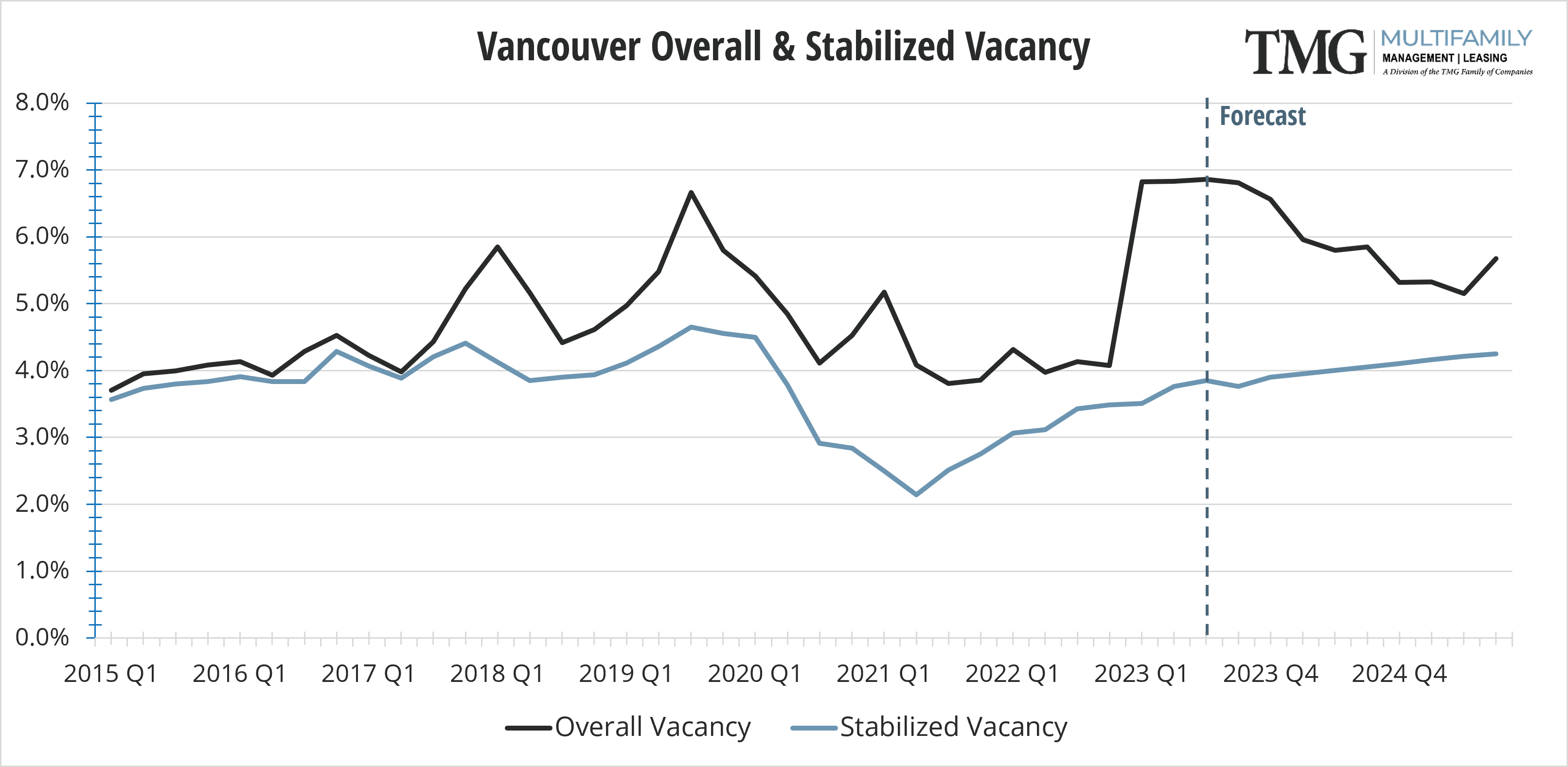

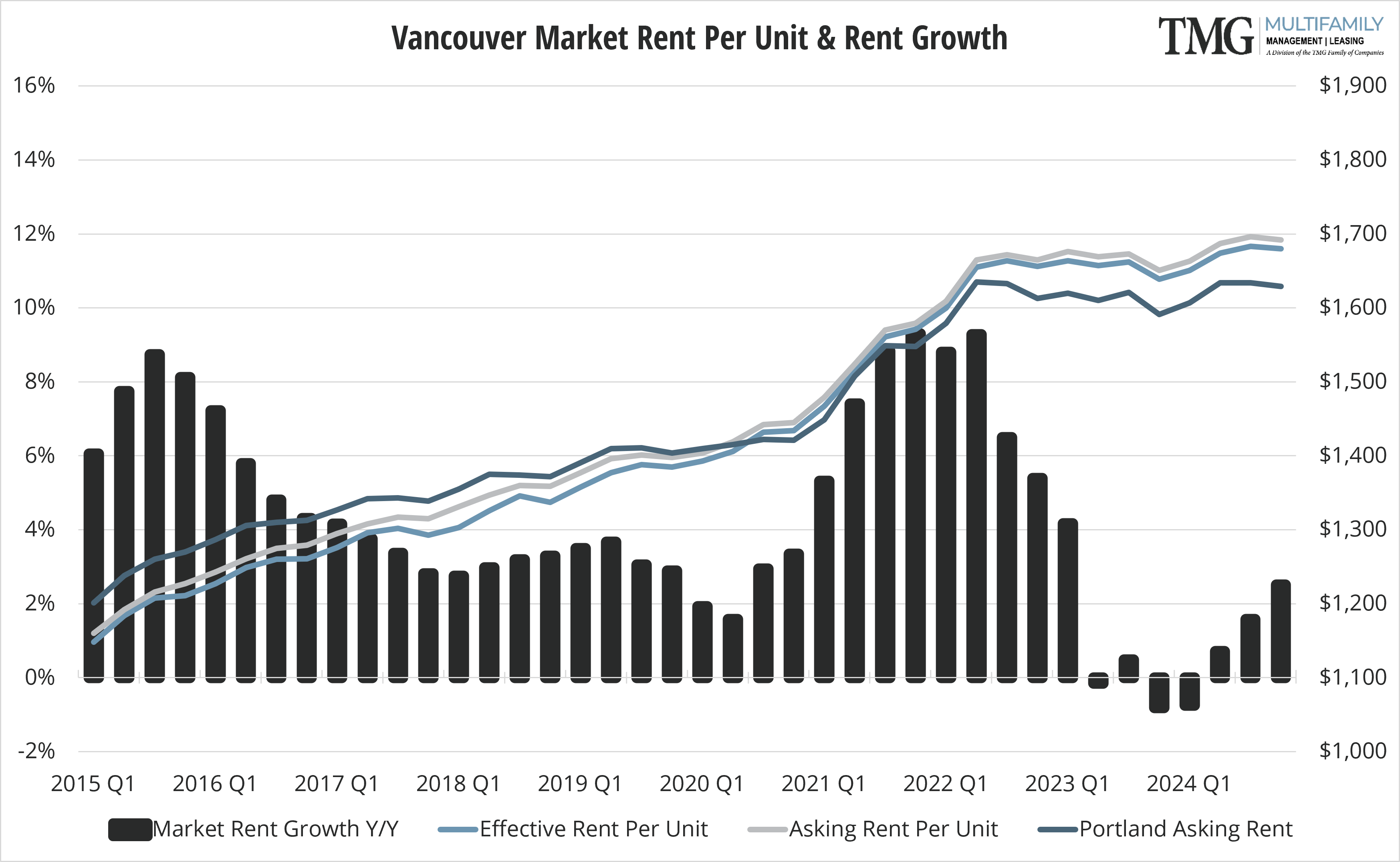

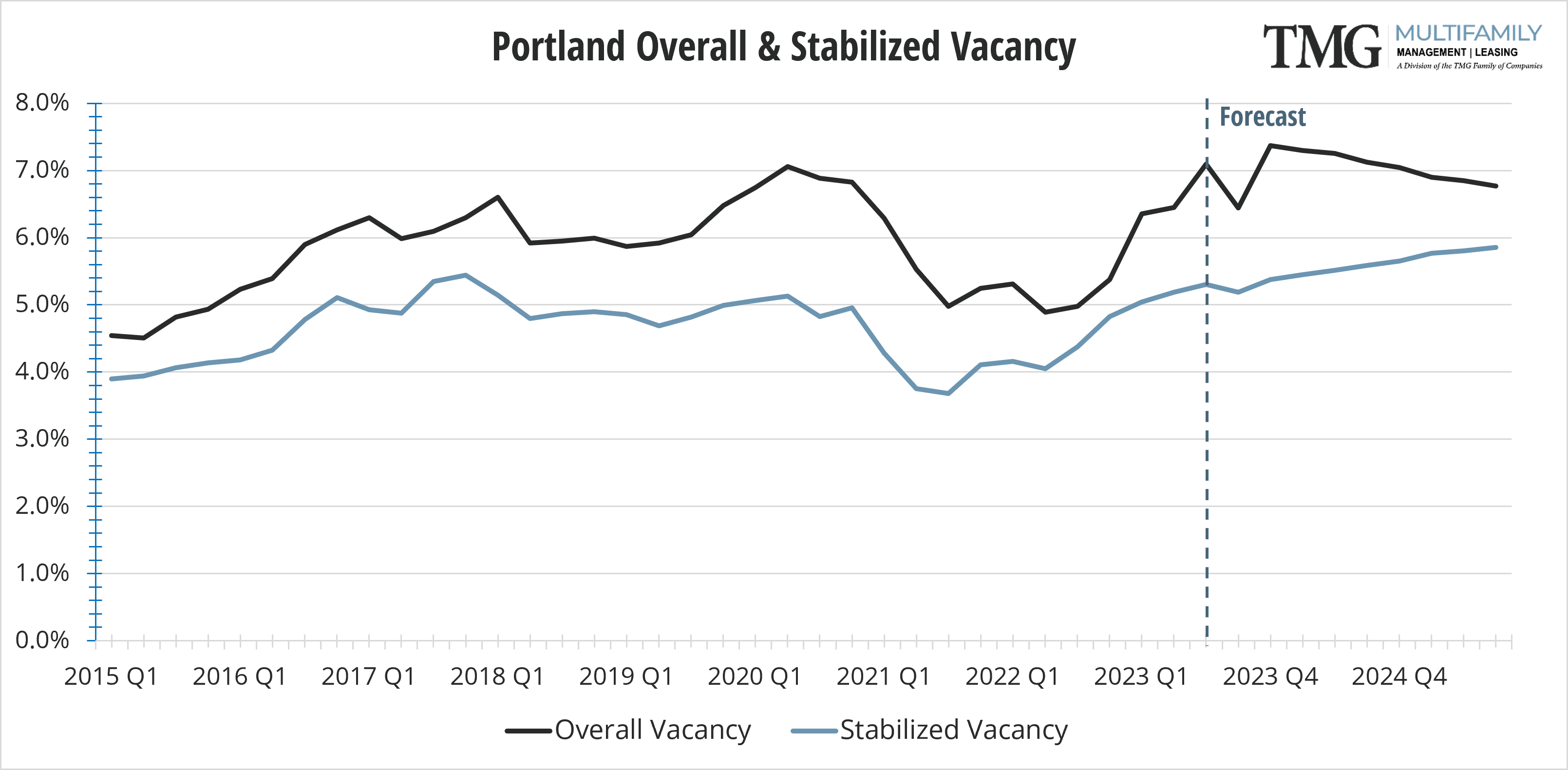

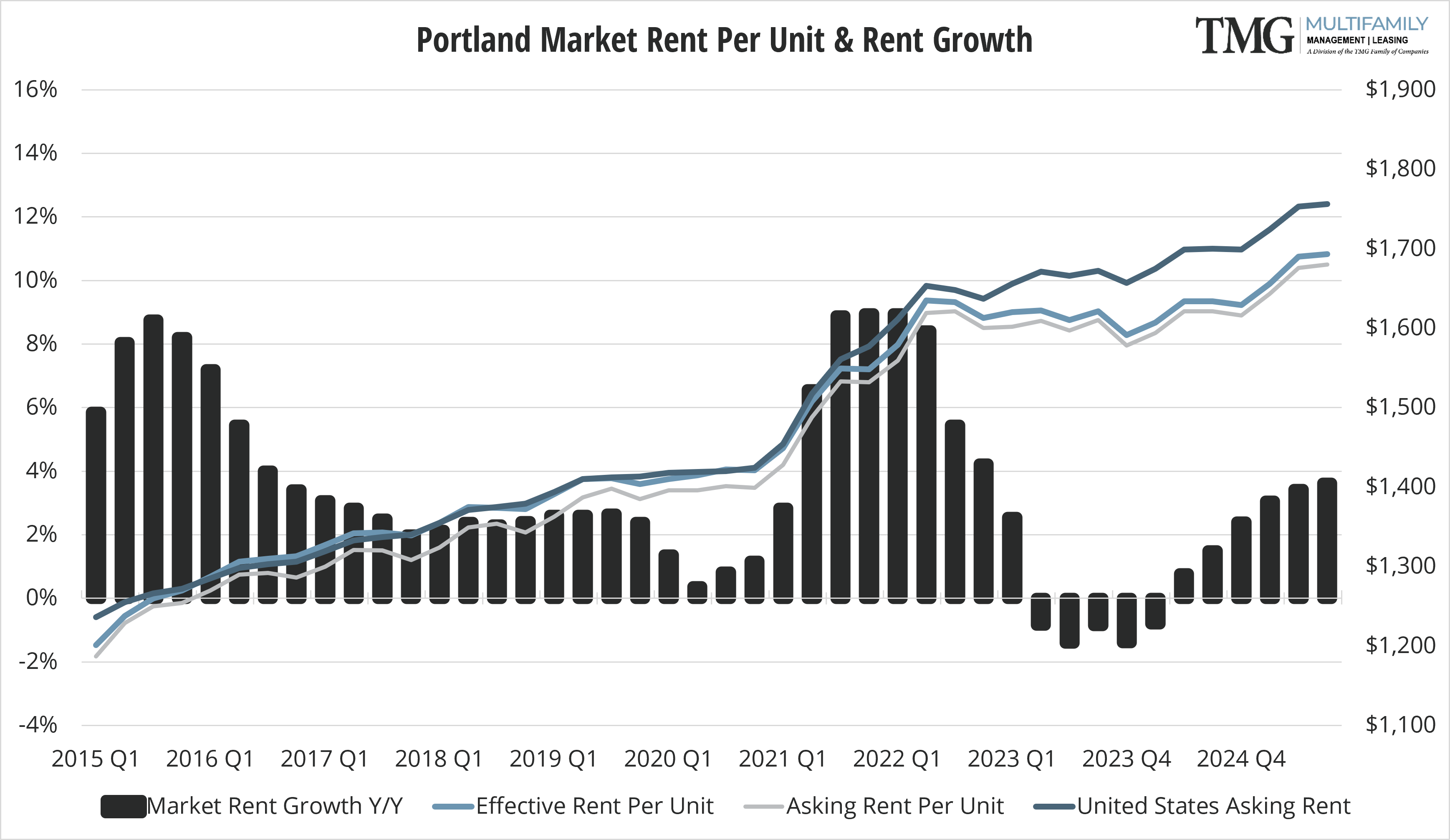

The substantial increase of new construction apartment supply, particularly in Portland and Vancouver, has caused vacancies to increase and concessions to be the norm in the market. All new construction lease ups in these two markets are offering up to 8 weeks of concessions, hoping to hold on to previously projected rents. Renter traffic is at its highest during the summer months, however, there are a considerable number of new construction projects that will be released in late Q3 adding to the options renters already have.

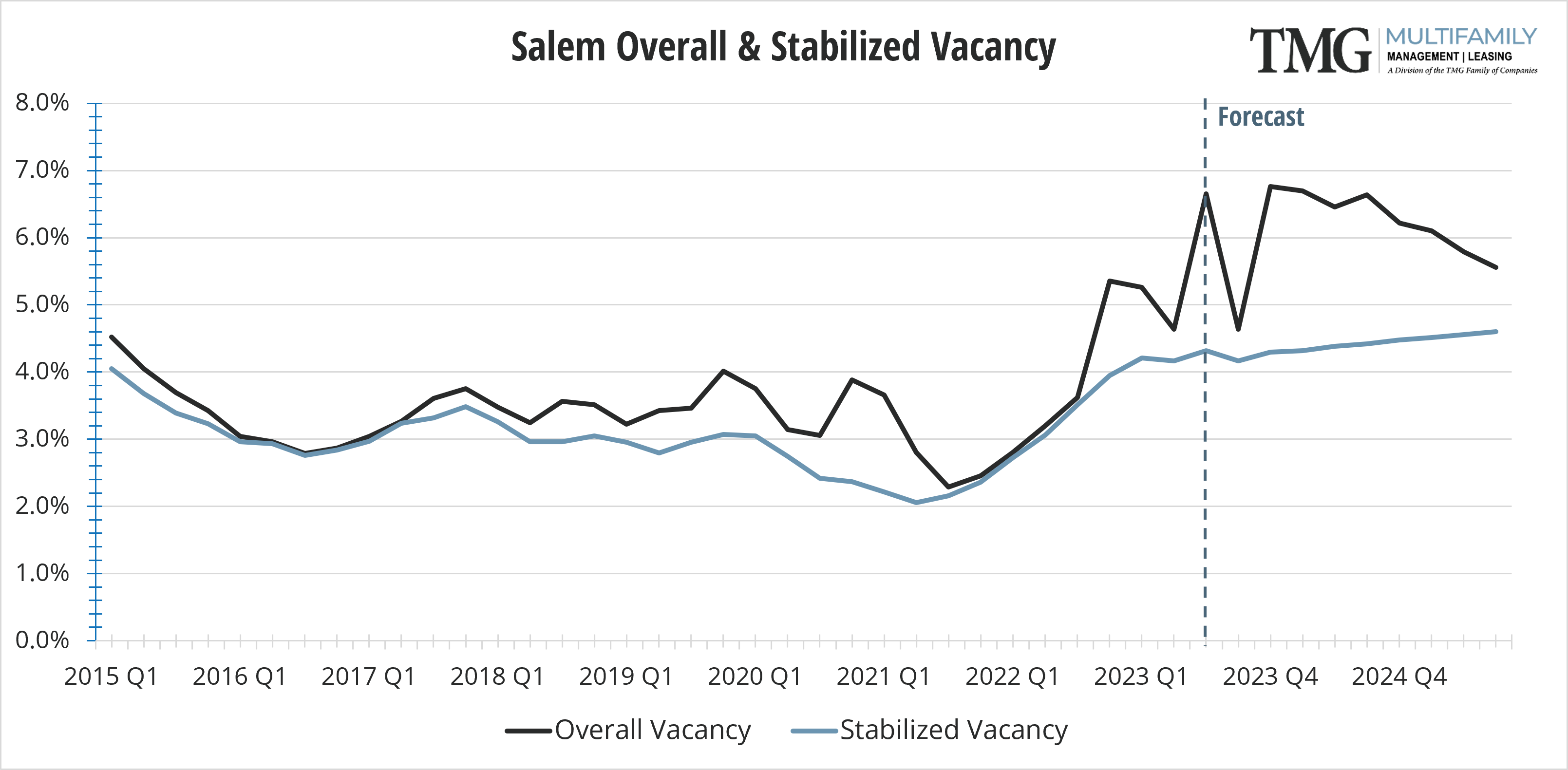

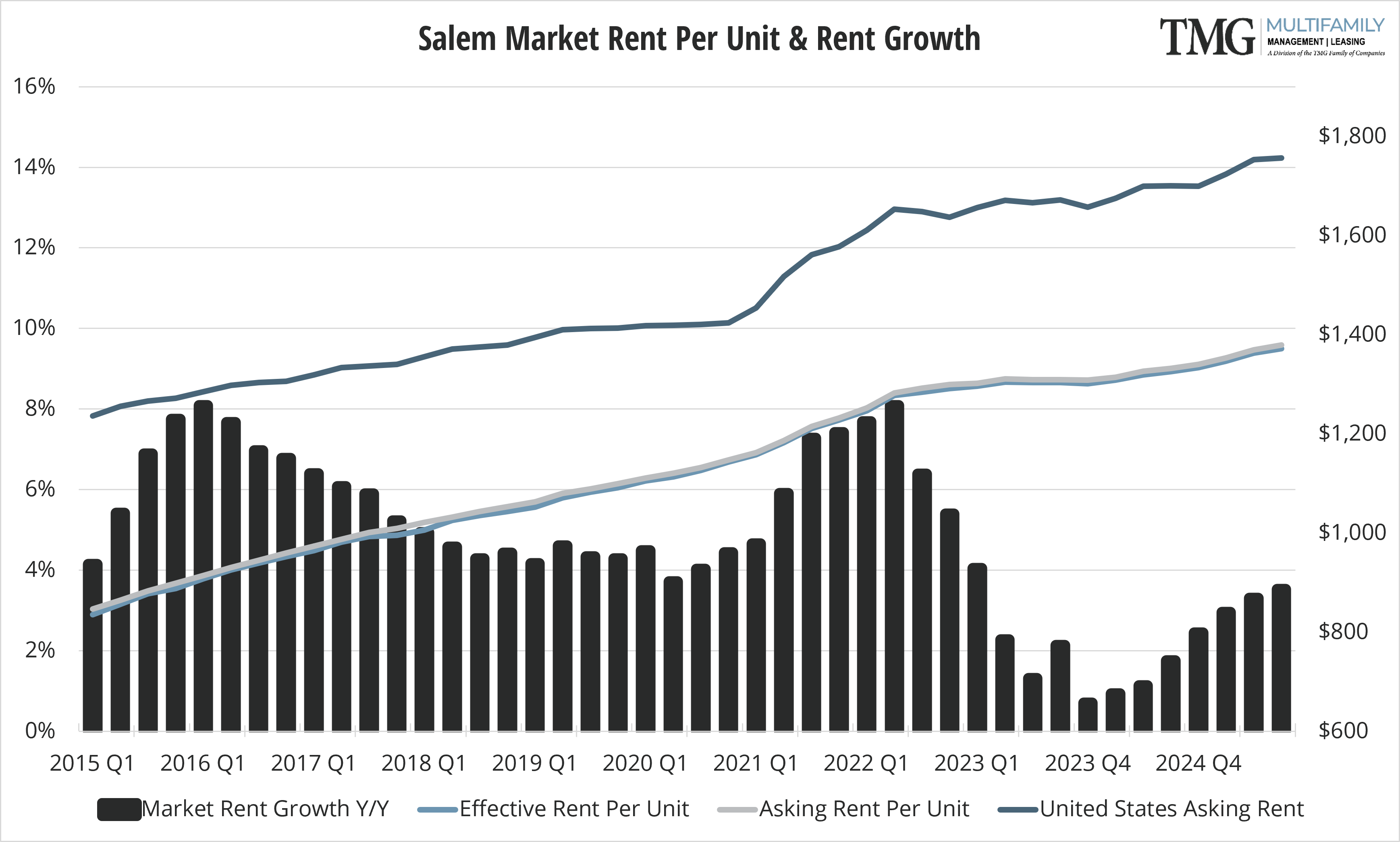

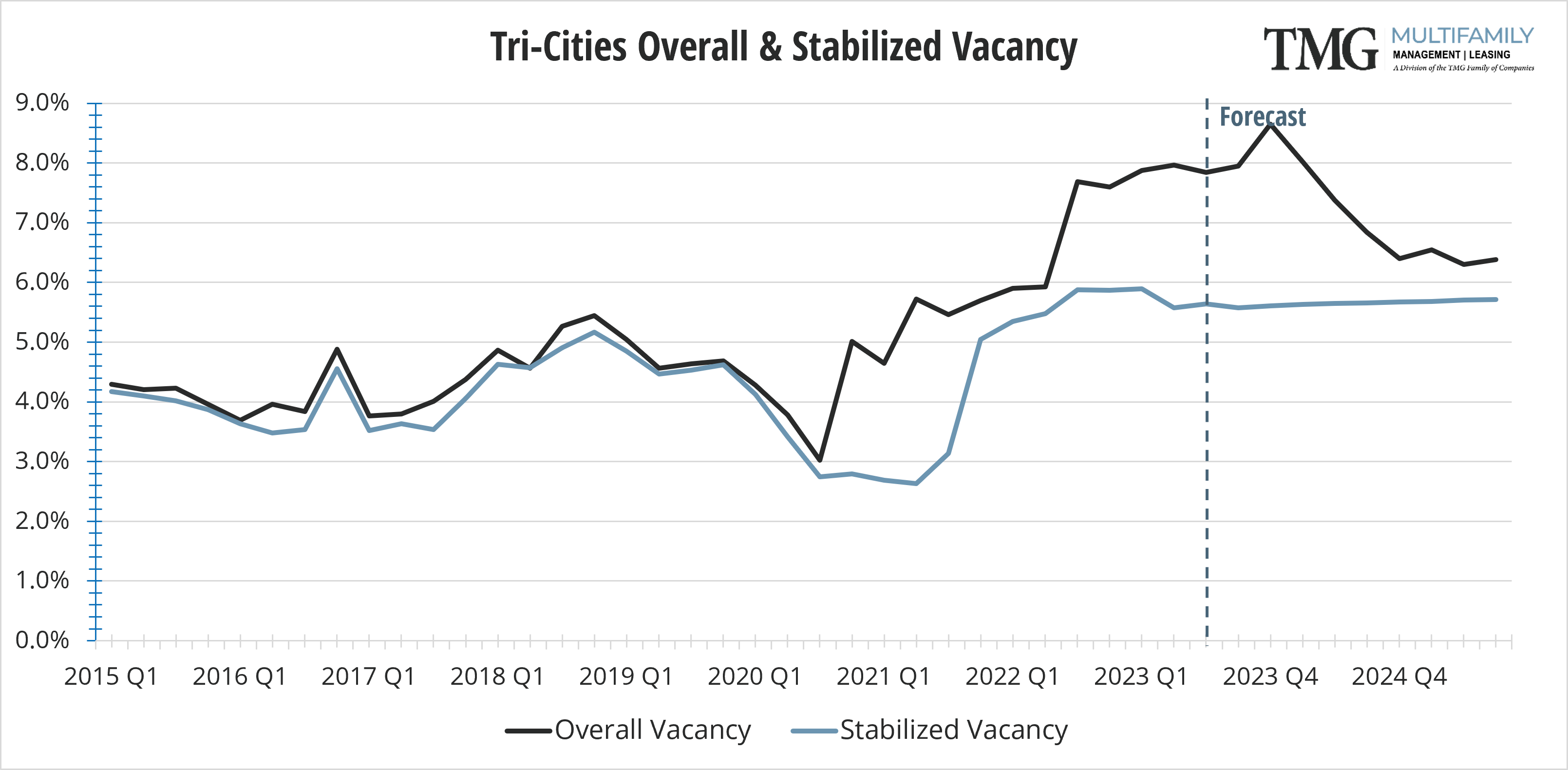

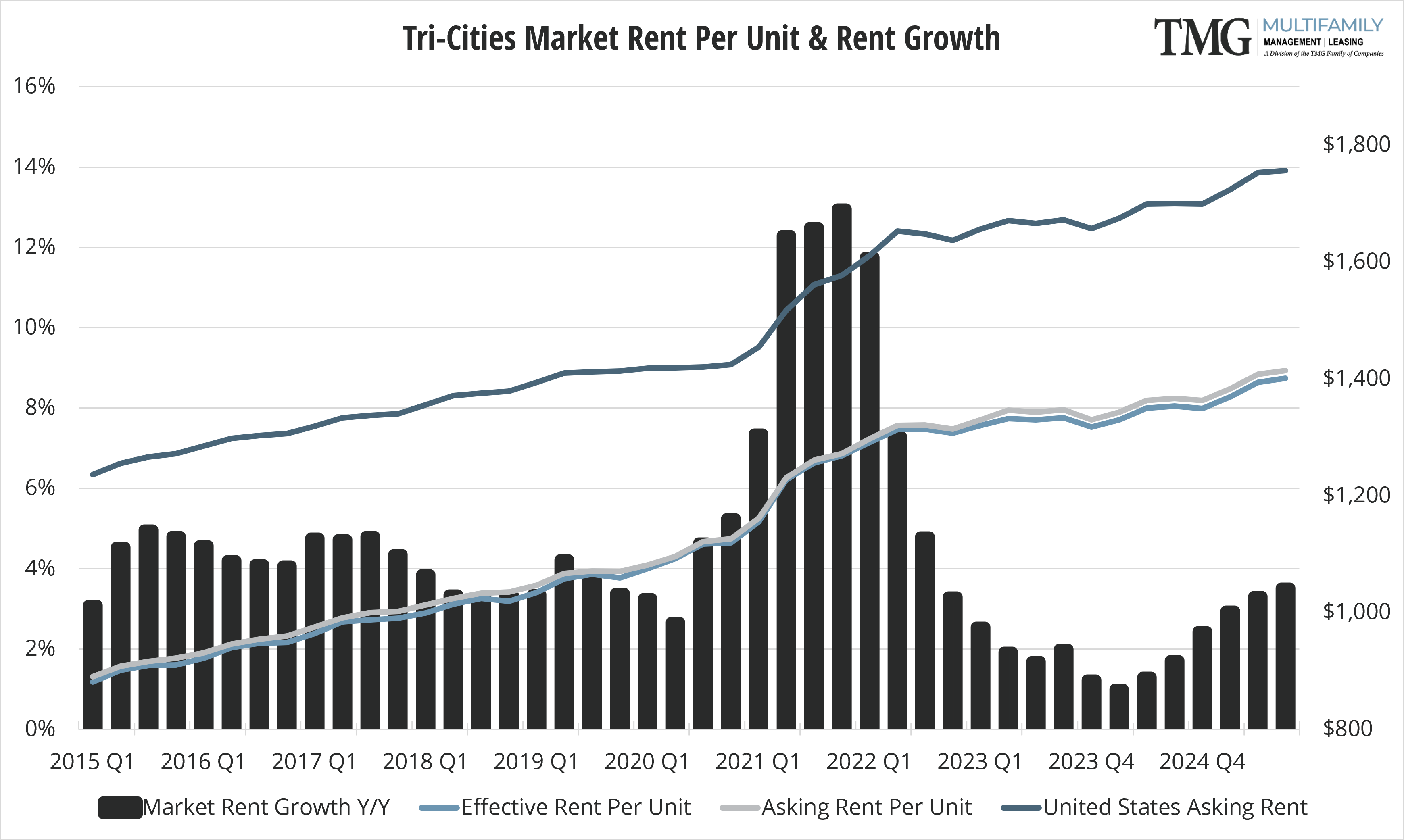

Salem and Tri-Cities tell a little different story. These markets also had significant new deliveries in the last 12 months relative to their market size and this Q2 report shows a slight decrease in vacancy rates for both areas.

All 4 markets had a decline in the 12 month asking rent growth from Q1. Portland took the first hit into negative rent growth at -0.9% and while Vancouver is at 0.5% that is quite a decline from the 4.2% rent growth reported in Q1. Salem also experienced a significant drop in rent growth from Q1, dropping to 2.1% from 4.0%. Tri-Cities historically has had a very stable housing market and while rent growth did decline, it was a very modest .20%.

Delinquency in all markets has almost returned to “normal,” although nearly every property has a tenant or two with large past balances that are part of the required payment plans that Landlords are obligated to continue.

A note on value-add and Class C properties; rents for new construction and renovated units are becoming increasingly competitive along with reduced income qualifications and of course rent concessions. This offers tenants much broader housing choices. Those properties that do not have plans to renovate or invest in some upgrades soon will likely experience even higher vacancies and lower rents as we move into Q3 and Q4.

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar