| Q2 • 2022 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

Multifamily Rent Growth Slows in Q2

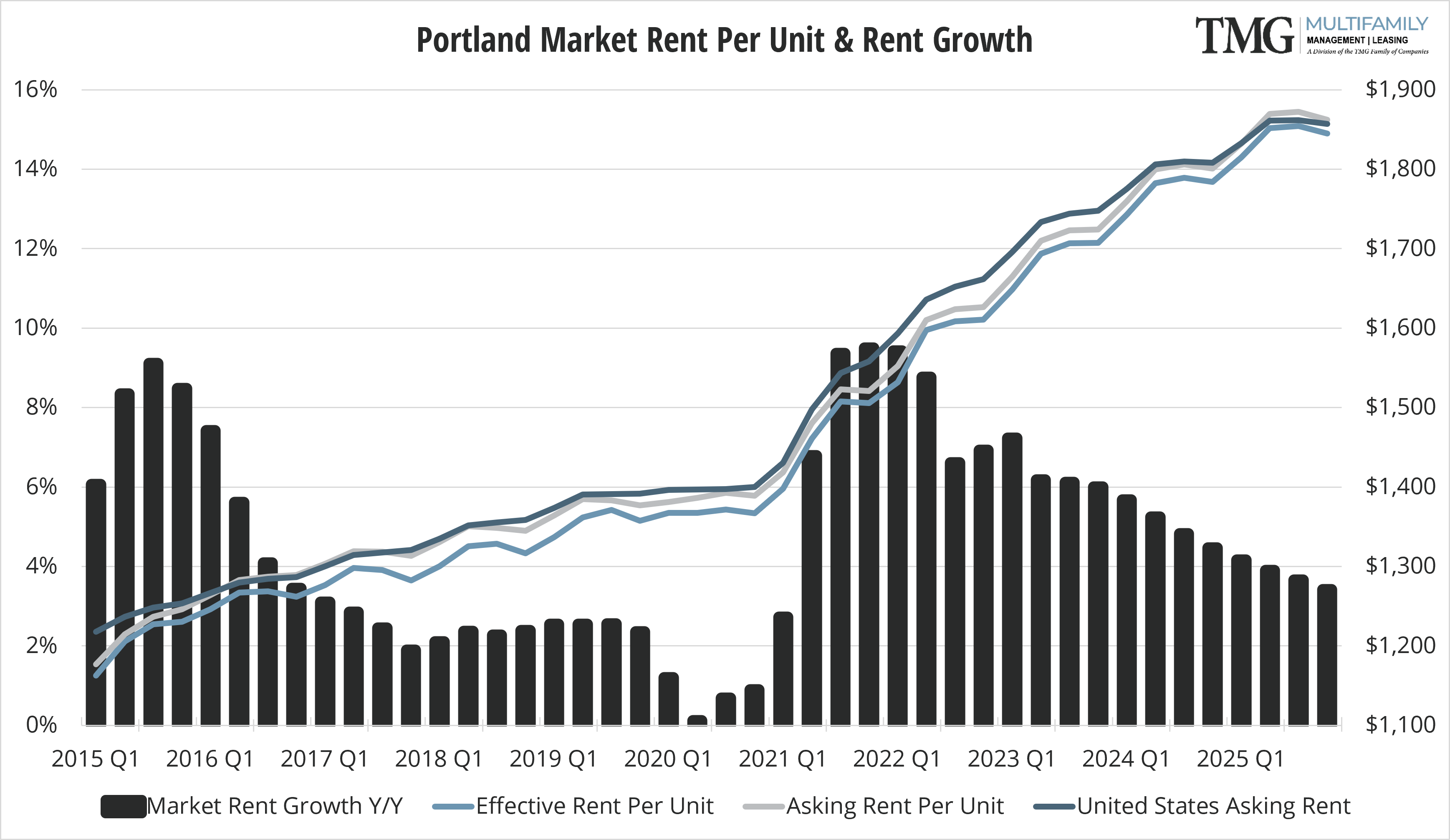

According to a new report from CoStar Group, the national year over year rent growth was 9.2% in the second quarter of 2022, down from 11.4% in the first quarter. These findings mark a continued downward trend in rent growth, with this now being the third quarter in a row of diminishing demand. The report also found that the vacancy rate is up 10 basis points, rising to 5% nationally.

Rents sitting at all-time highs plus the tight vacancy rate has tempered demand slightly, as potential household formations can no longer afford or find an available apartment to rent. However, making a larger negative impact on multifamily demand has been rising inflation and growing economic uncertainty that has gripped the nation throughout 2022. These factors have pushed consumer confidence to record lows, despite employment growth averaging almost 500,000 jobs a month year to date and unemployment sitting at just 3.6%.

While wages have increased dramatically in nearly all sectors, inflation and higher rents are beginning to elevate delinquency rates. With the removal of the eviction moratoriums and sheer demand for housing, this is not expected to be a long-term trend. The increase in interest rates has contributed to the rental housing demand as first-time homebuyers have been priced-out of the market and will continue to be renters. Increased construction costs and labor shortages have slowed the availability of new units coming on line 2022.

New Construction: There were 10,677 units under construction in Portland as of April, with development activity staying strong. Portland added 857 units in the first four months of 2022, representing 0.5% of existing stock.

Six submarkets had at least 500 units under construction as of the beginning of Q2; Downtown Vancouver (977 units), Gresham (666 units), Southwest Hills (572 units), Kerns/Buckman (545 units), Pearl District (532 units) and Hillside/Northwest (500 units).

Washington:

The following became effective on June 9th, 2022:

SSB 5749 – Methods of Rental Payments: Landlords are required to accept a personal check, cashier’s check, or money order for any payment of rent made by a tenant by mail, unless an accessible onsite location to pay rent is available or unless the landlord or landlord’s agent has received a rent check from the tenant in the previous 9 months that was returned for insufficient funds or account closure.

ESHB 2064 – Security Deposit Options: Creates requirements around the use of security deposit alternatives and provides transparency of the product to tenants including maximum insurance coverage, and clearly identifies tenants remain liable for unpaid rent and damages, despite paying a “fee in lieu of a security deposit.” This means that the property is the insured and the leasing consultants are considered the insurance agents. There is no real direct relationship with the insurer and the tenant.

Oregon:

The following became effective the moment it was passed:

SB 1536 – Emergency Heat Relief Bill: Signed into law on March 24, 2022 amending the Oregon Residential Landlord Tenant Act to limit restrictions on renter use of portable cooling devices from May to September of each year. It also requires that housing providers provide cooling devices in new construction.

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar