| Q3 • 2022 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

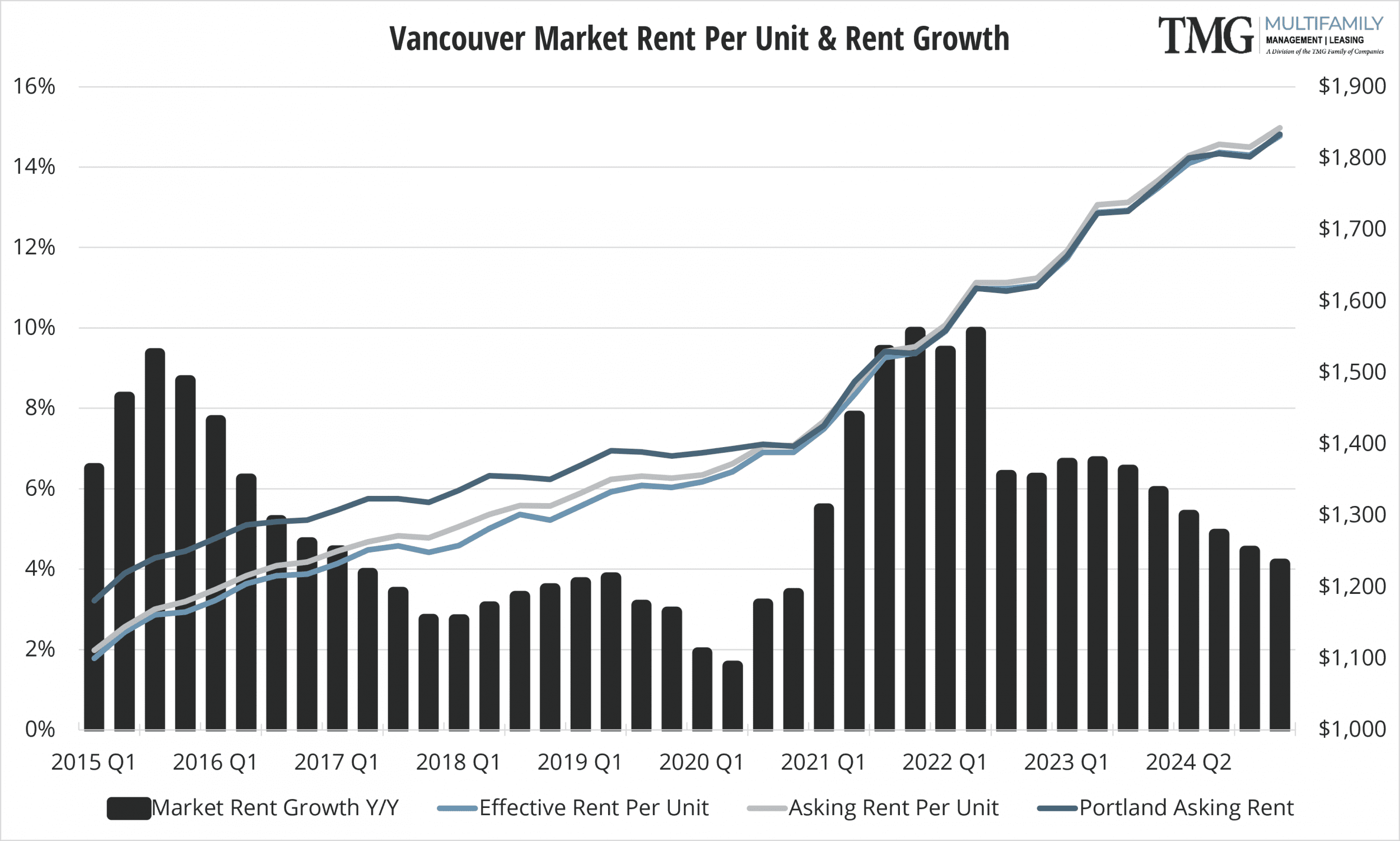

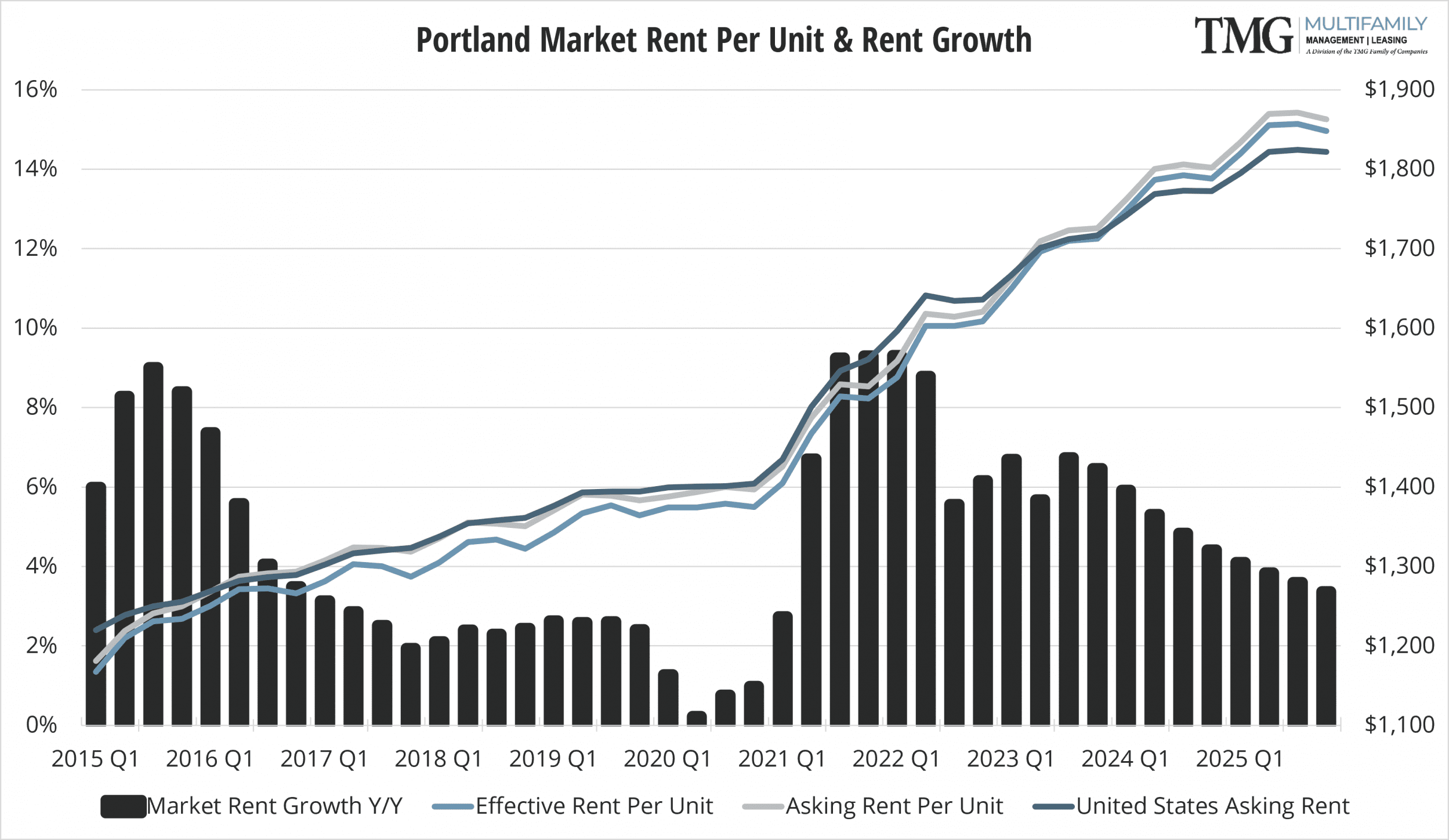

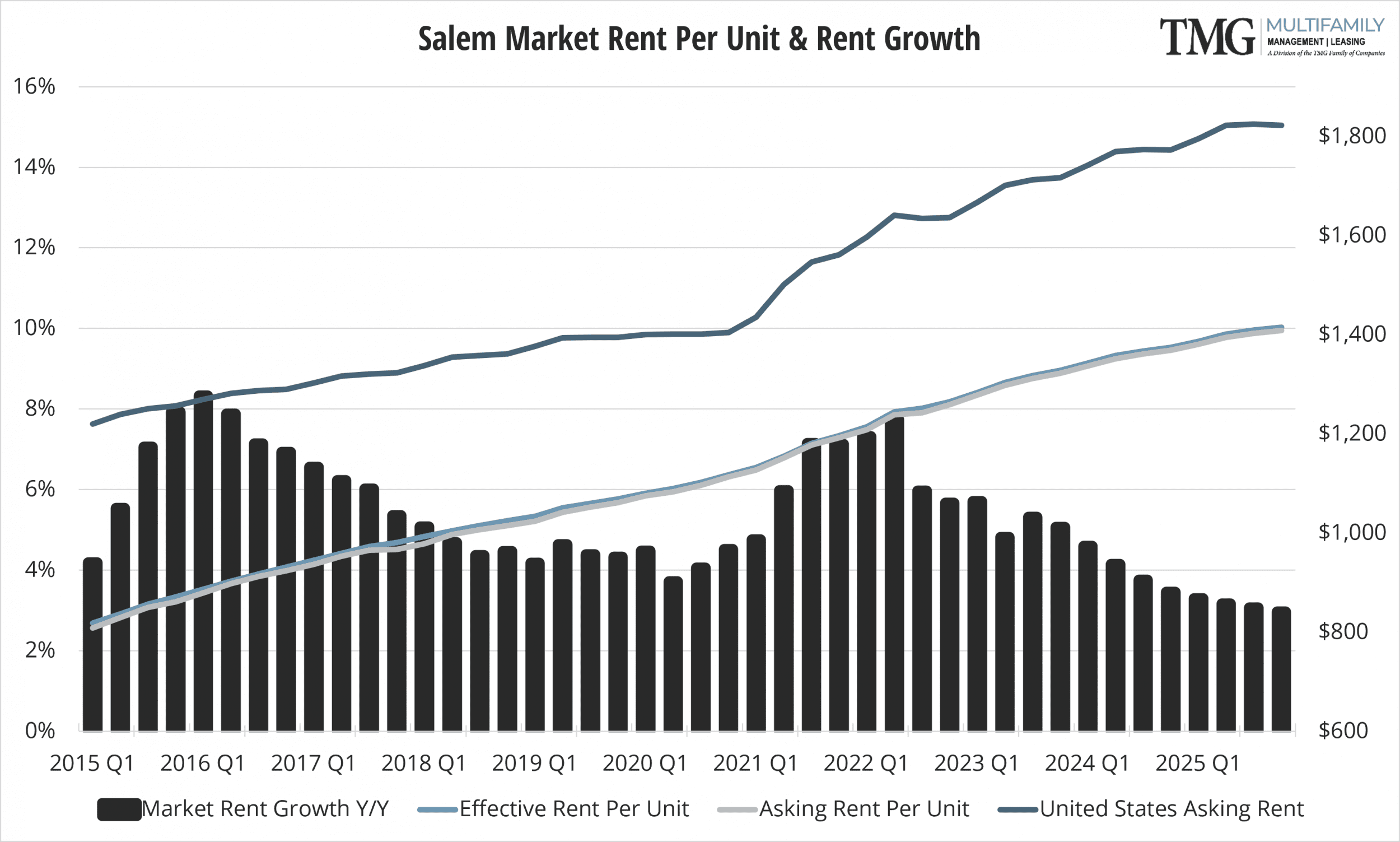

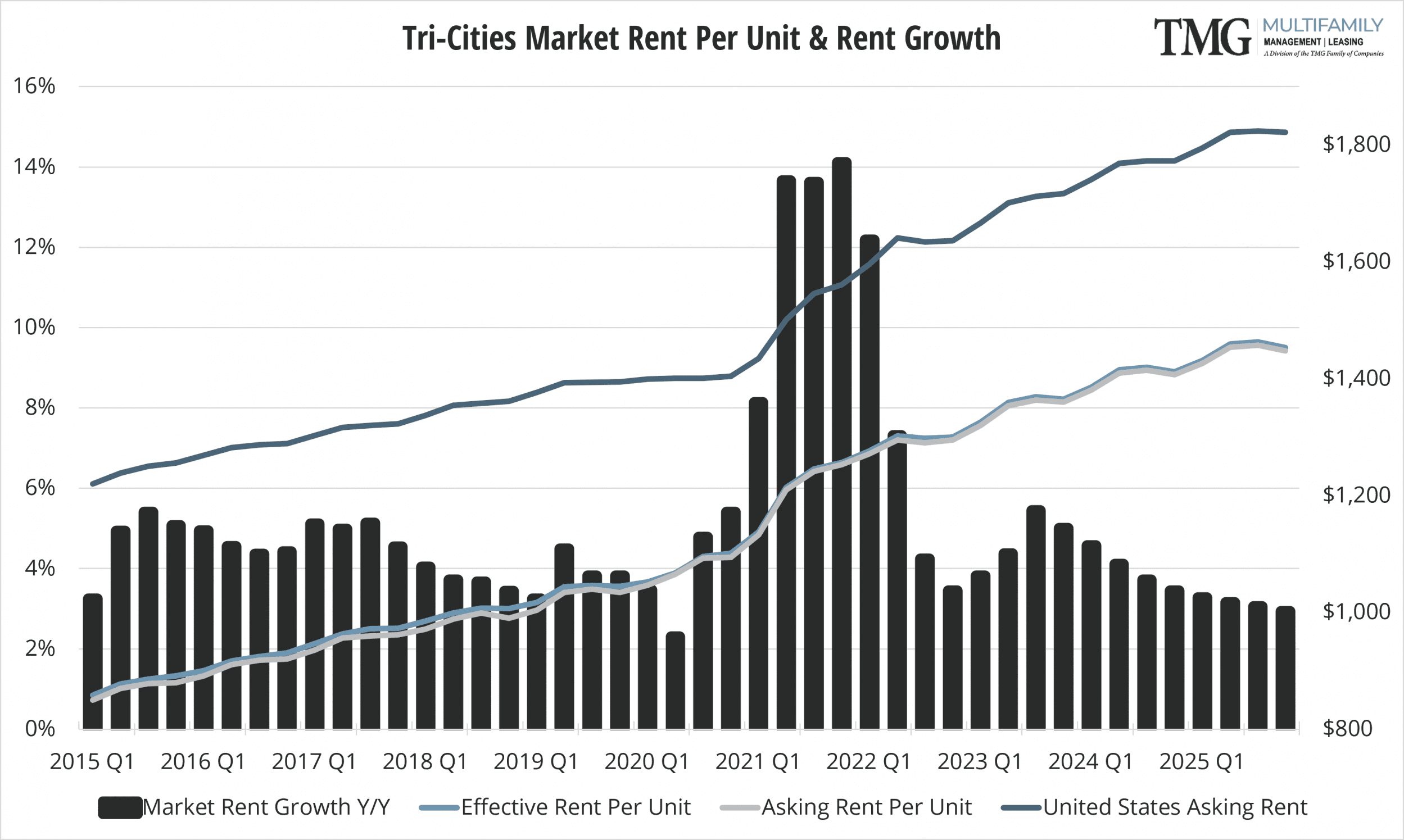

In September 2022, the U.S. rental market experienced single-digit growth for the second month in a row. The median rent growth across the top 50 metros slowed to 7.8% year-over-year. It is the lowest growth rate in 16 months but still more than 2X faster than the growth rate seen just before the pandemic hit in March 2020.

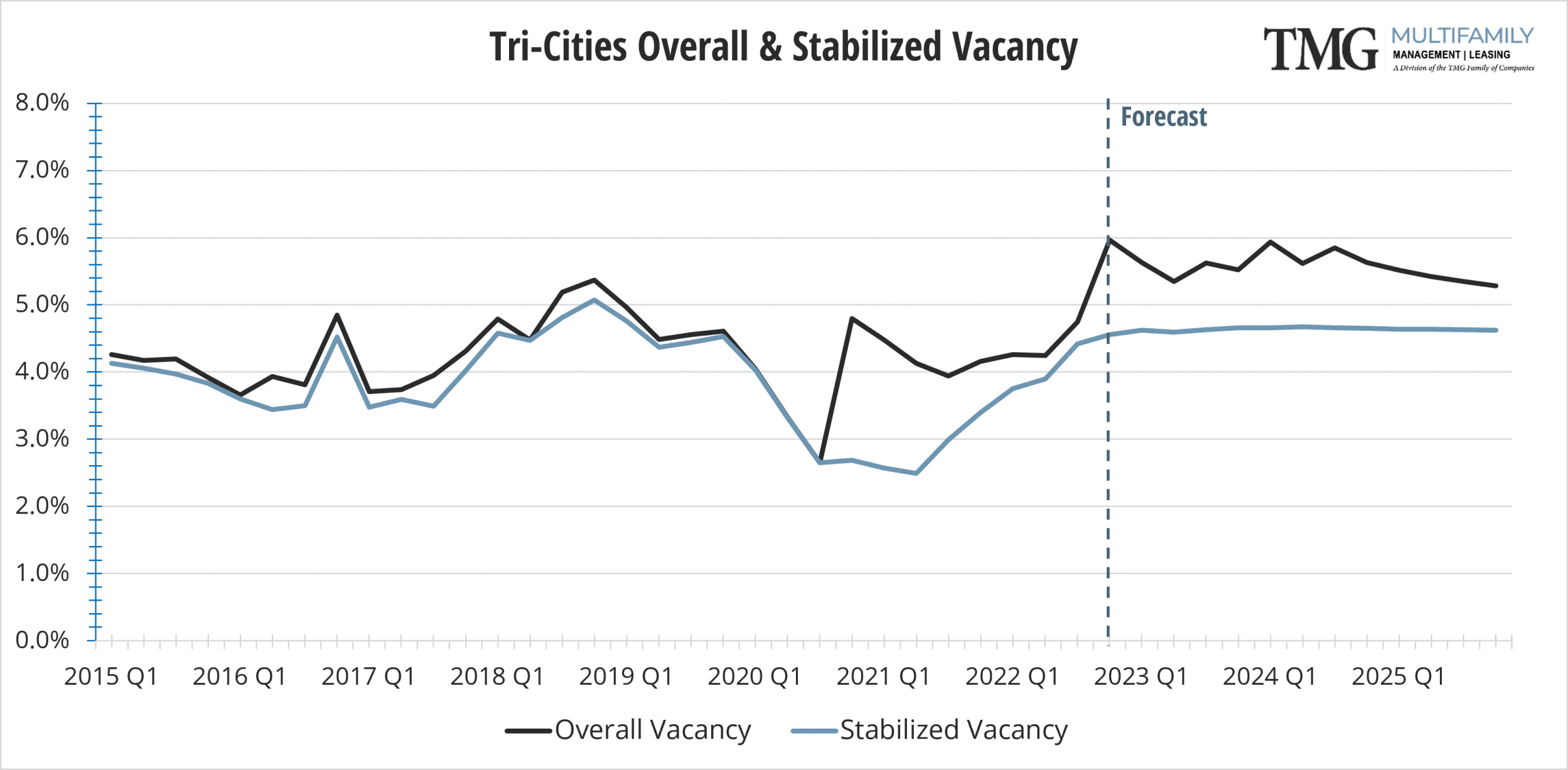

The increase in interest rates is now affecting the demand for rental housing. With fewer renters leaving the rental market for homeownership, vacancy rates continue to remain low, keeping rental price growth elevated but still off the highs of previous months. We are starting to see moderation in asking rents. The in-place rents (tenants currently in a lease) will likely have significant rent increases ahead of them before they catch up to the growth in the asking rents we’ve seen. Inflation is effectively outpacing the wage growth renters have seen over the past 18 months and we may begin to see delinquency rates climb higher in 2023.

Builders are still ramping up multifamily production and the supply of housing in 2023 is predicted to increase, albeit not enough to tip the scales significantly. The increase in interest rates for permanent financing on new apartments in 2023 may necessitate higher rents in order to capture the original return most builders projected early on, just one more reason rent growth will continue.

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar