| Q4 • 2023 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

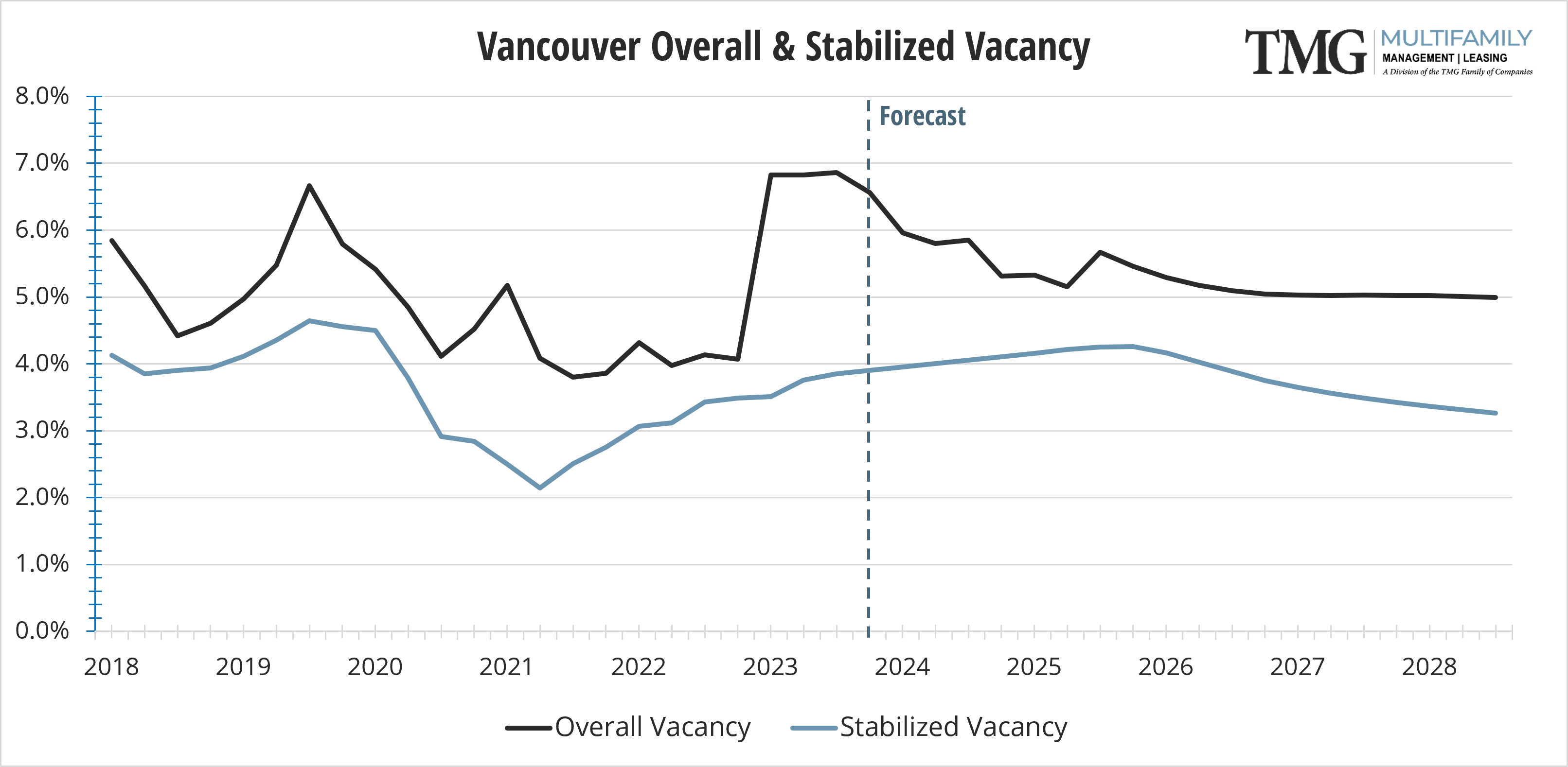

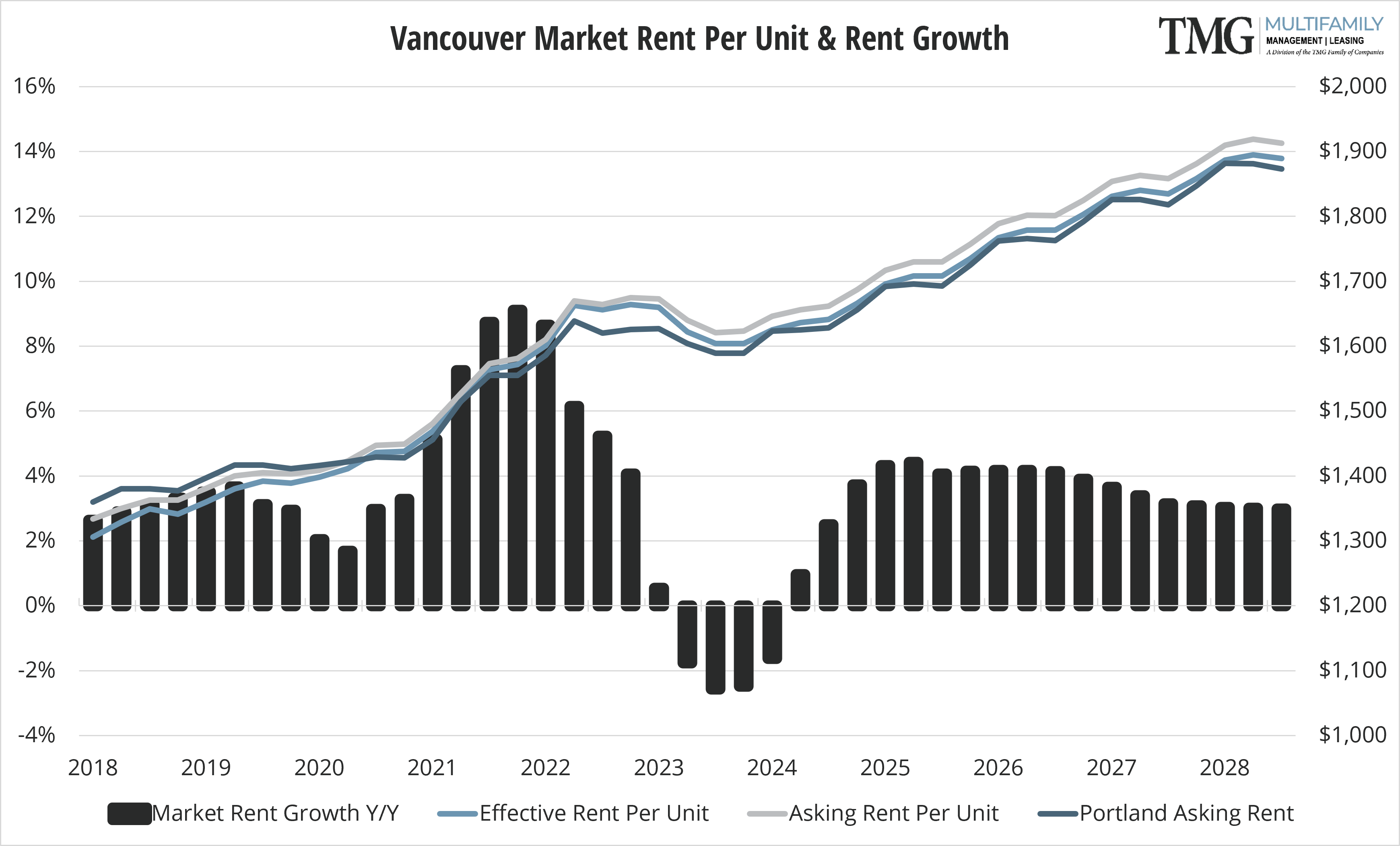

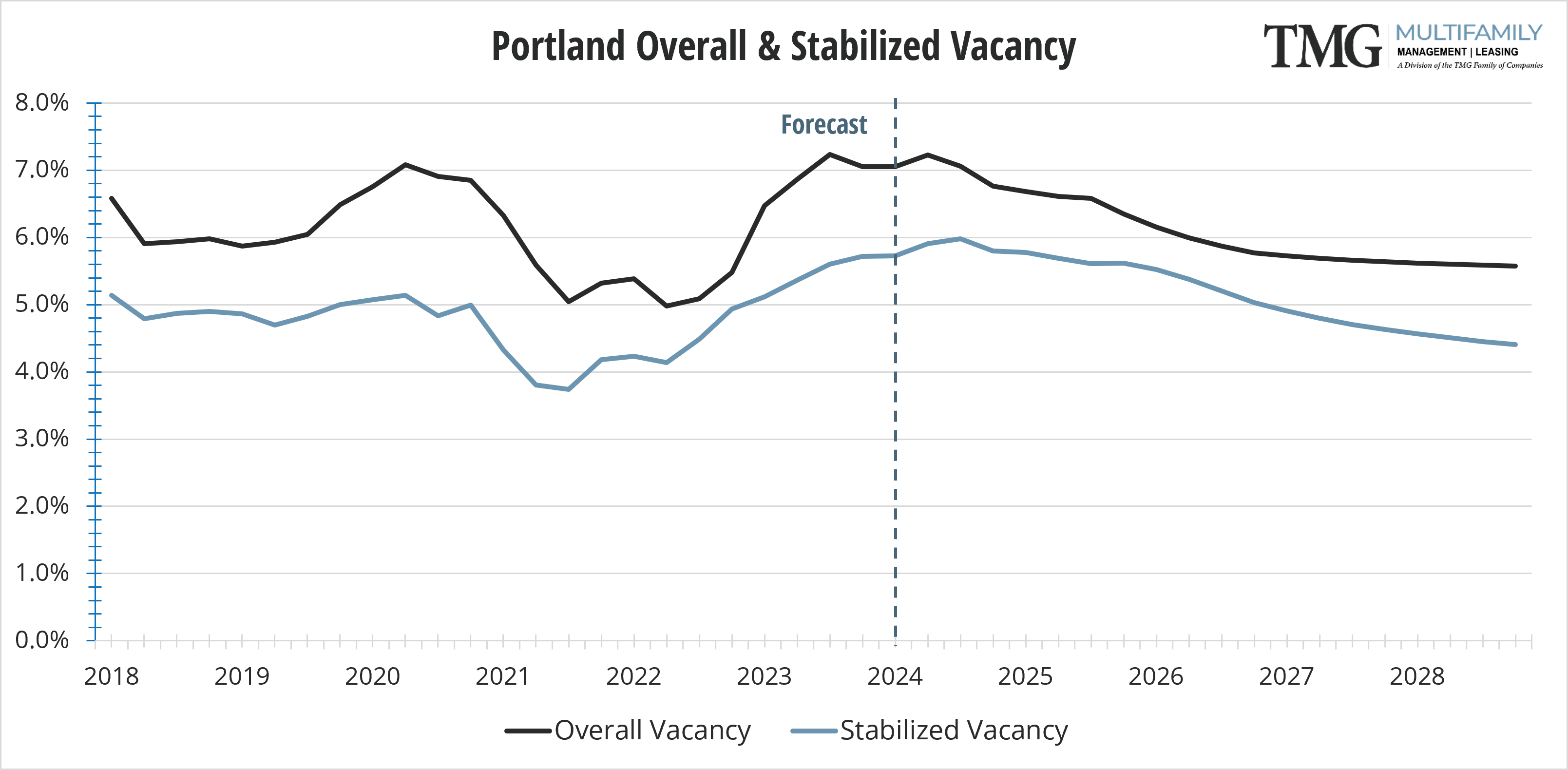

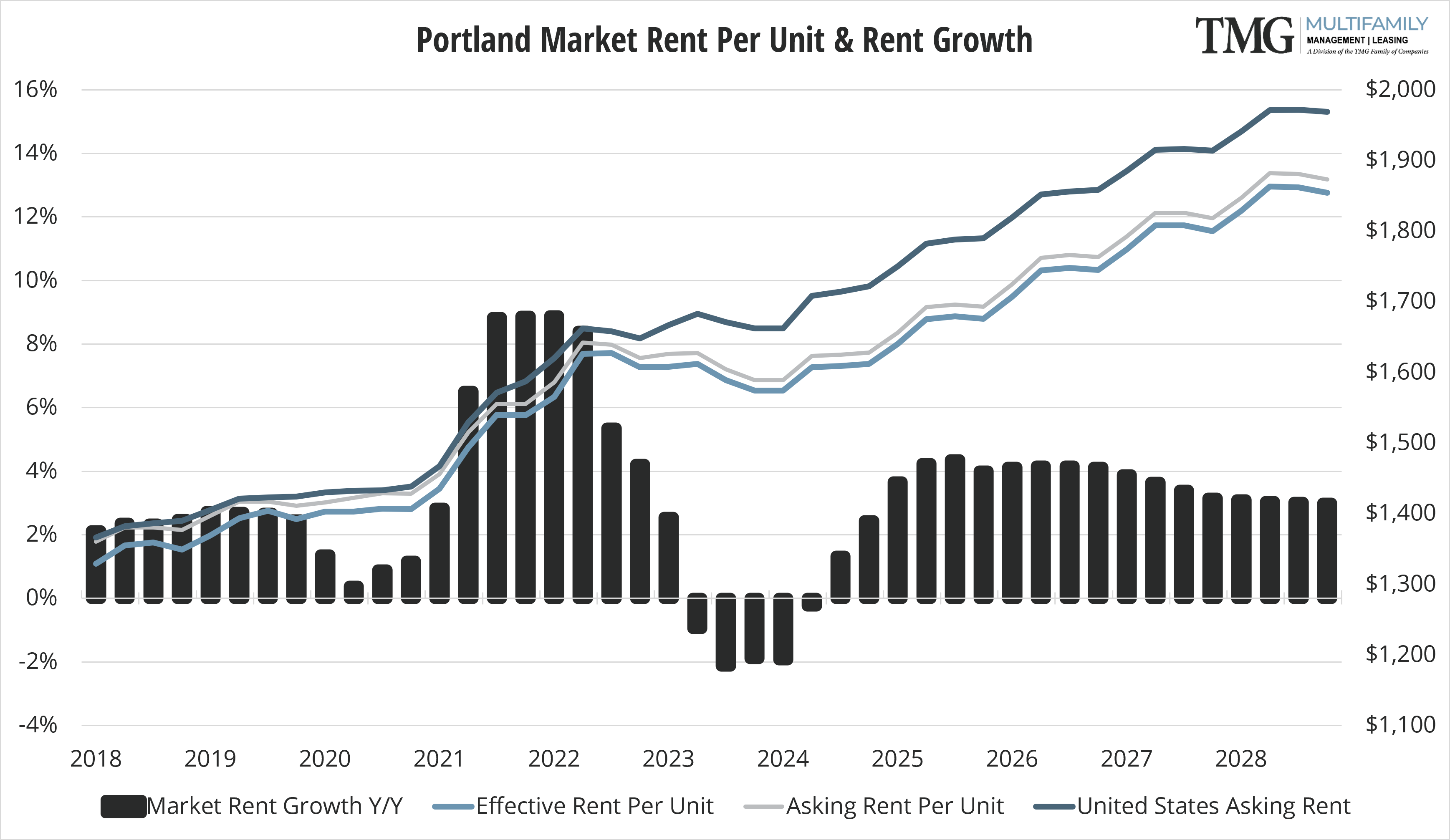

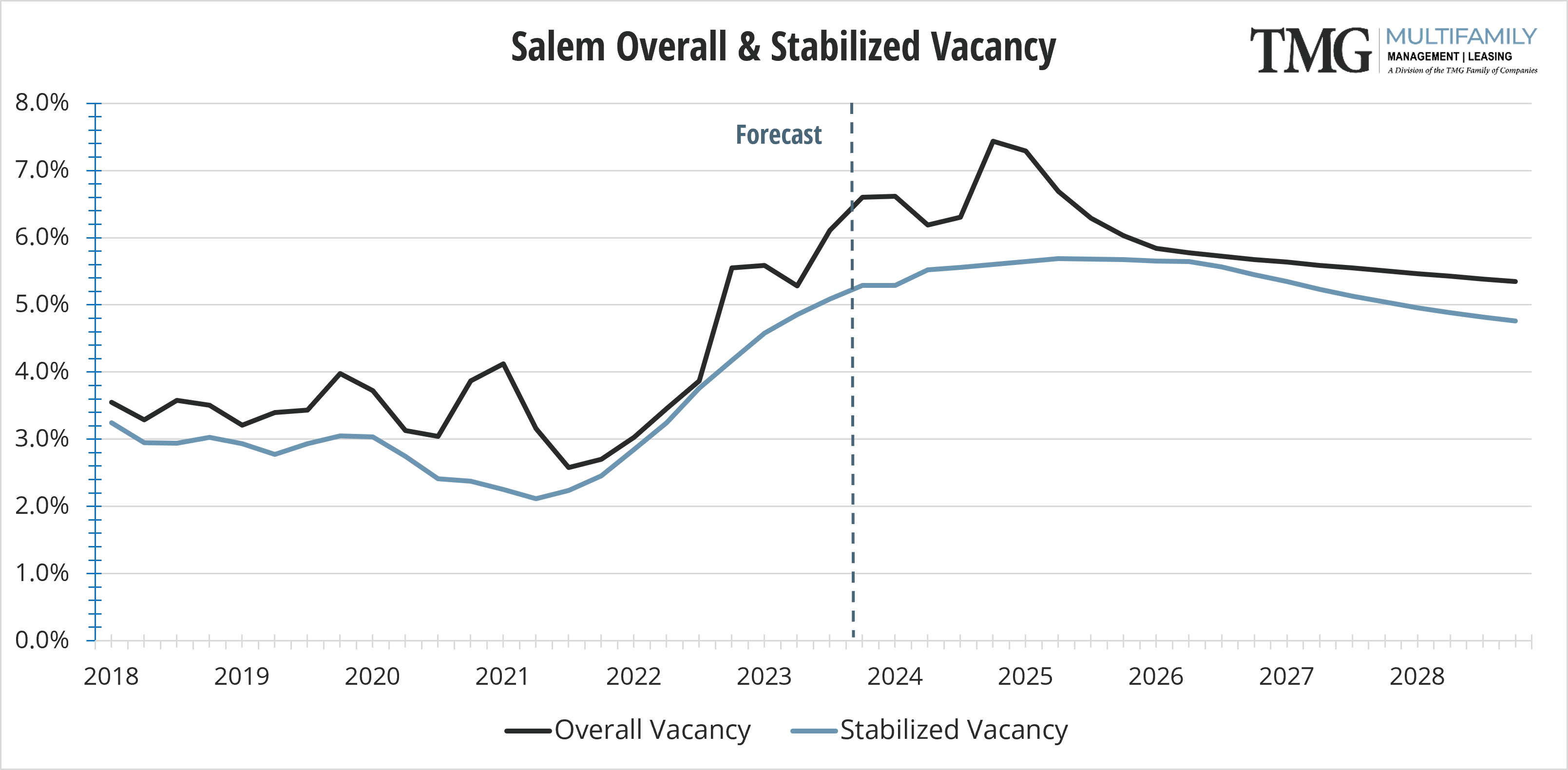

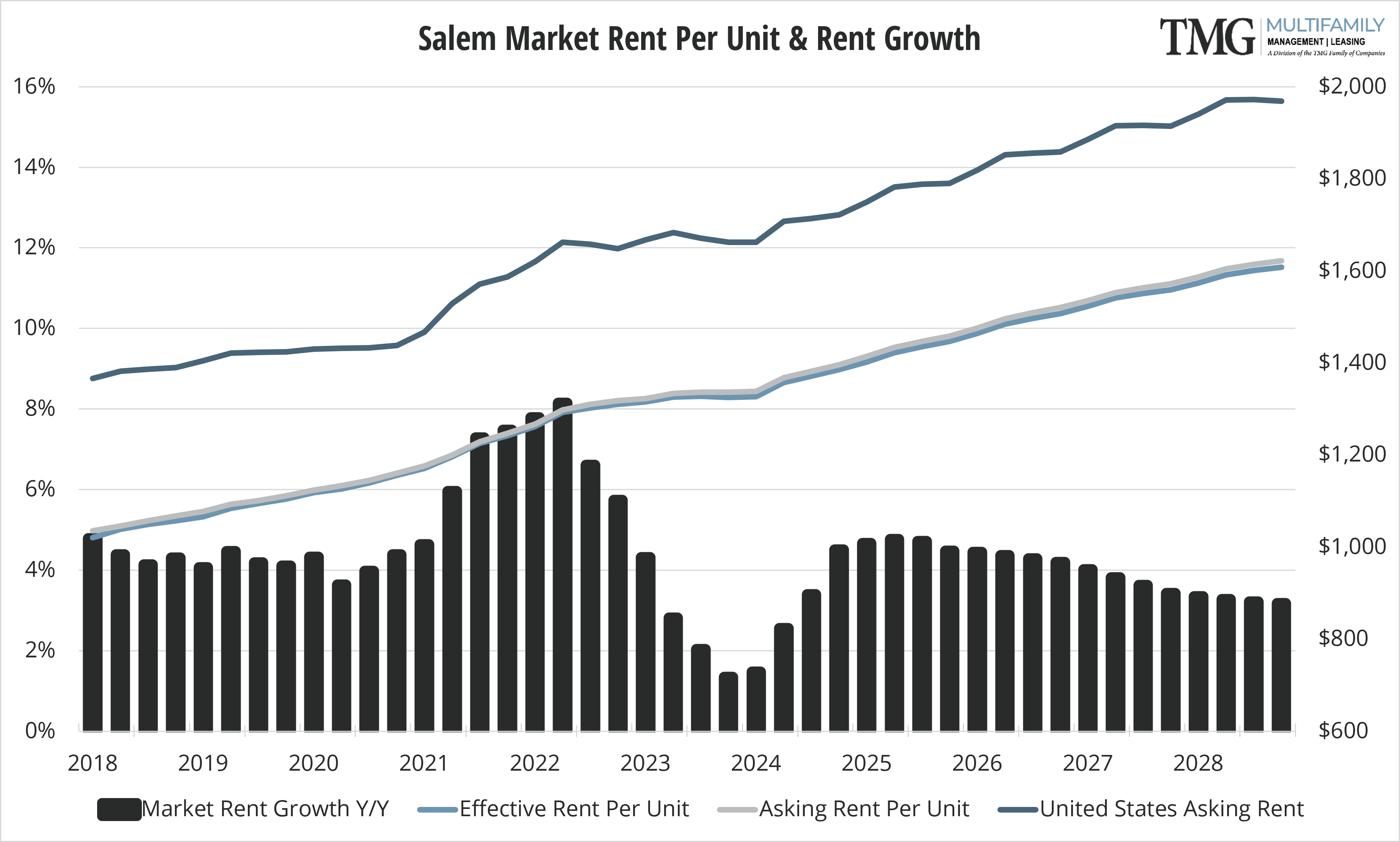

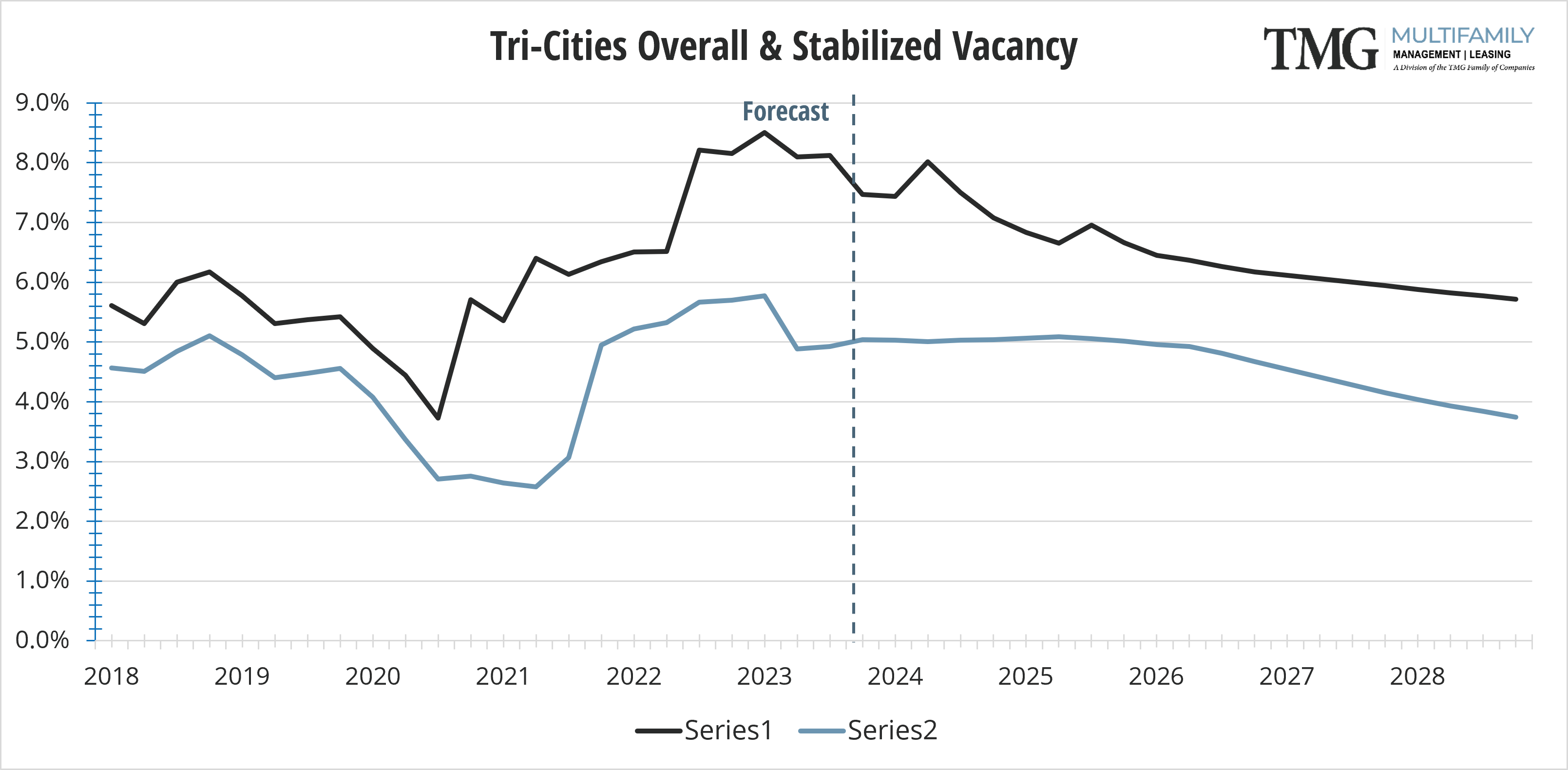

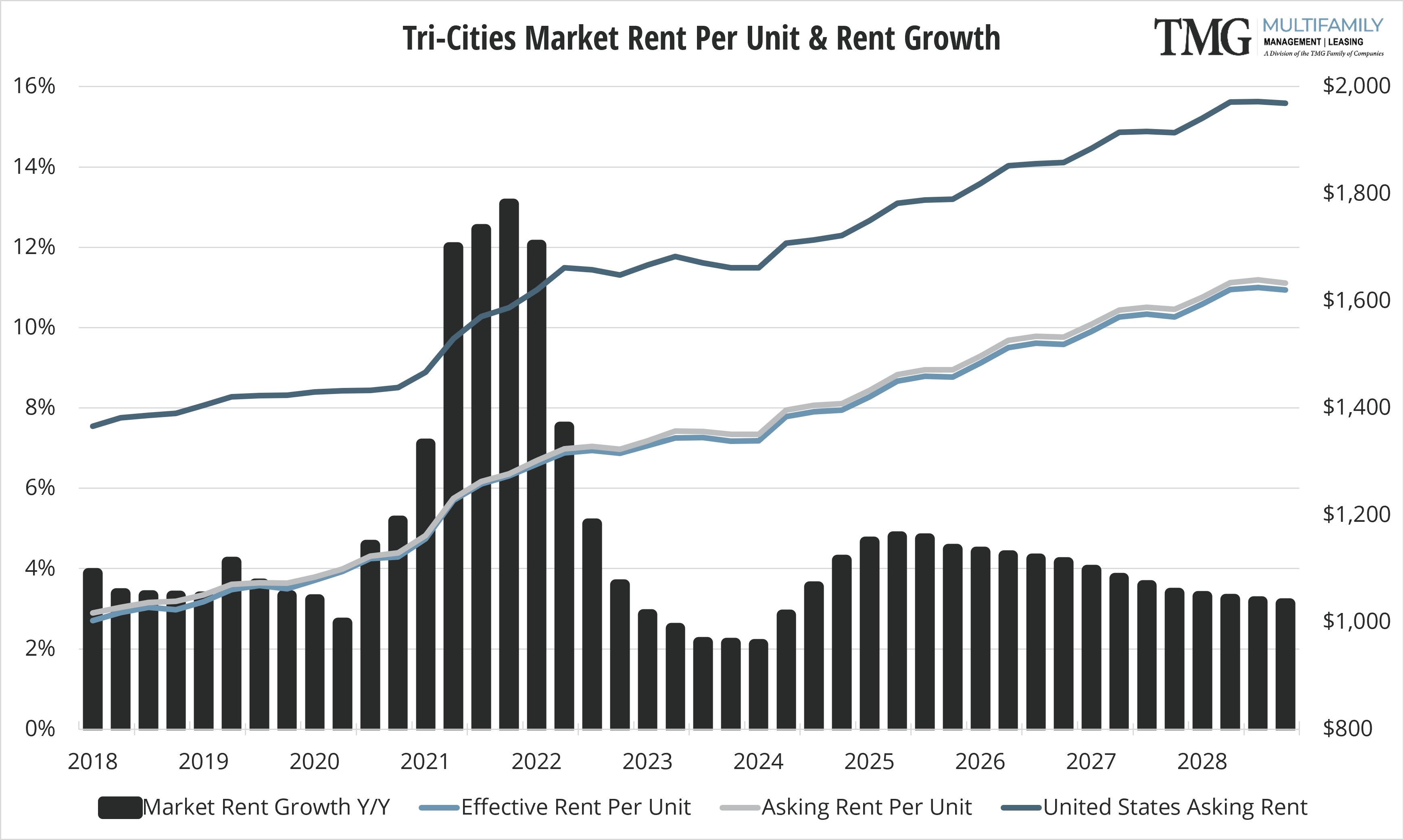

Vancouver and Tri-Cities’ vacancy rates are slightly down from Q3. Portland had a negligible increase, while Salem, still enjoying the lowest vacancy rate among the four markets, had the highest increase in vacancies since Q3. The Salem and Tri-Cities markets were still producing rent growth at 1.5% and 2.1% respectively. Vancouver enjoys an above-average rent over the Portland/Metro markets at $1620 per unit. However, Vancouver’s negative rent growth is the highest at 2.5%.

Incentives and concessions have been at play since Q2, along with reduced security deposits and other move-in costs. The slowdown in absorption, combined with extended lease-up times for new construction projects, is leading investors to offer significant concessions. This, in turn, is impacting stabilized properties, which are offering concessions to remain competitive in the market.

All markets saw a decrease in delivered units for Q4, except Tri-Cities, which experienced a 7% increase. Developers are waiting in the wings with approved projects in all markets. However, construction financing is challenging. Lenders will continue to underwrite very conservatively, basing their assessments on current market conditions rather than future growth expectations.

The Freddie Mac Multifamily 2024 Outlook projects an expected gross income growth of 2.1% for the year; “The Outlook indicates an elevated multifamily supply pipeline, with peak completions predicted in 2024, will moderate potential rent gains, which are expected to be positive in the year ahead, although below longer-run averages. The Outlook also forecasts 2024 vacancy rates will be modestly higher than average but notes a more stable interest rate environment could help spur transaction volume in 2024, with demand for rentals driven by prevailing demographic trends and expensive for-sale housing”. Despite a predicted peak year for deliveries, vacancy rates are expected to remain relatively stable in 2024 at 5.7%, 40 basis points higher than the 2000 to 2022 average.

Comment: All four markets were affected by the very recent ice, snow, and windstorms. Many properties had severe exterior and interior damage. The aftermath will involve some large capital expenditures and related insurance claims, as well as vacancy loss due to “down” units being restored.

2024 is going to be a bumpy ride!

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar