| Q3 • 2021 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

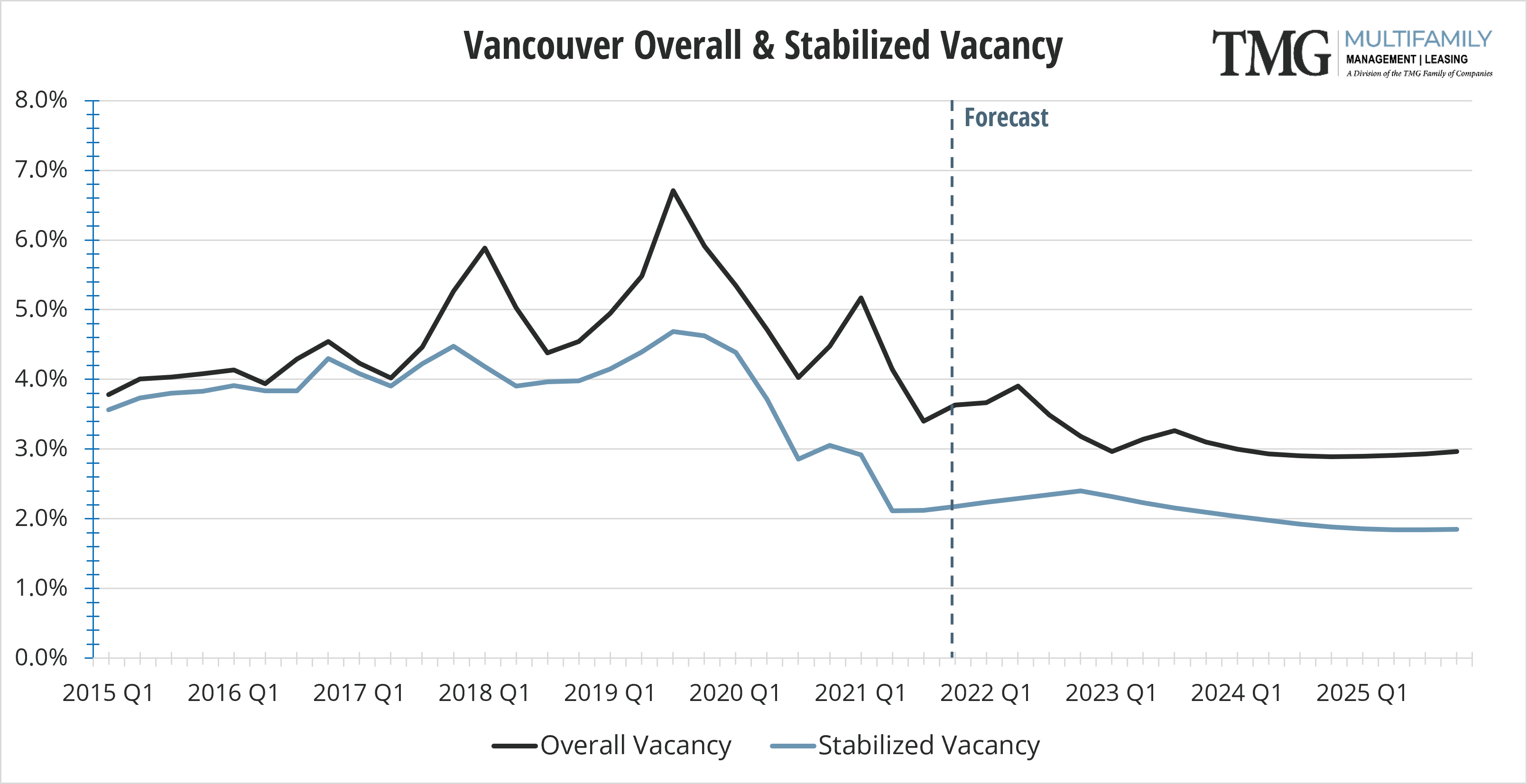

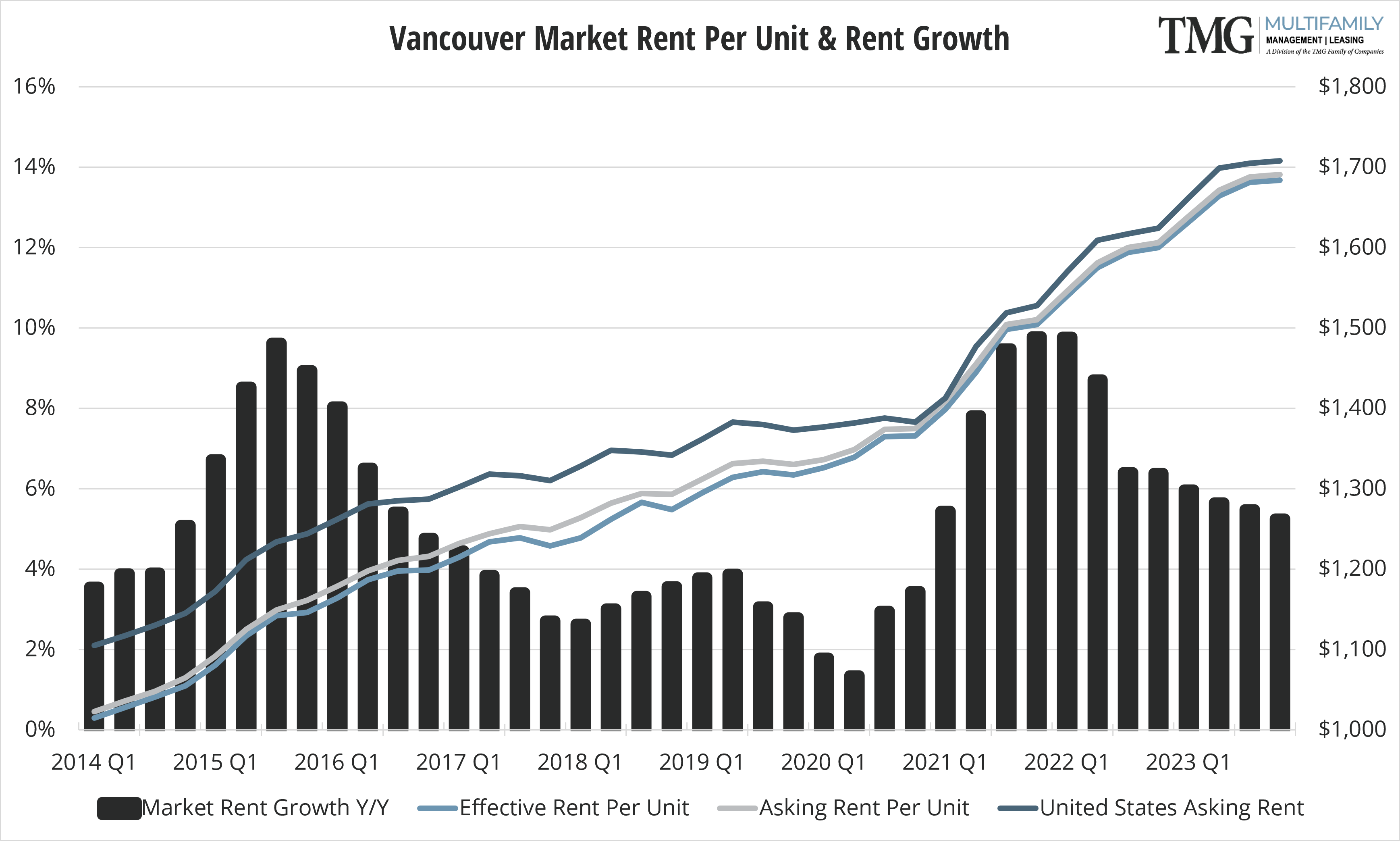

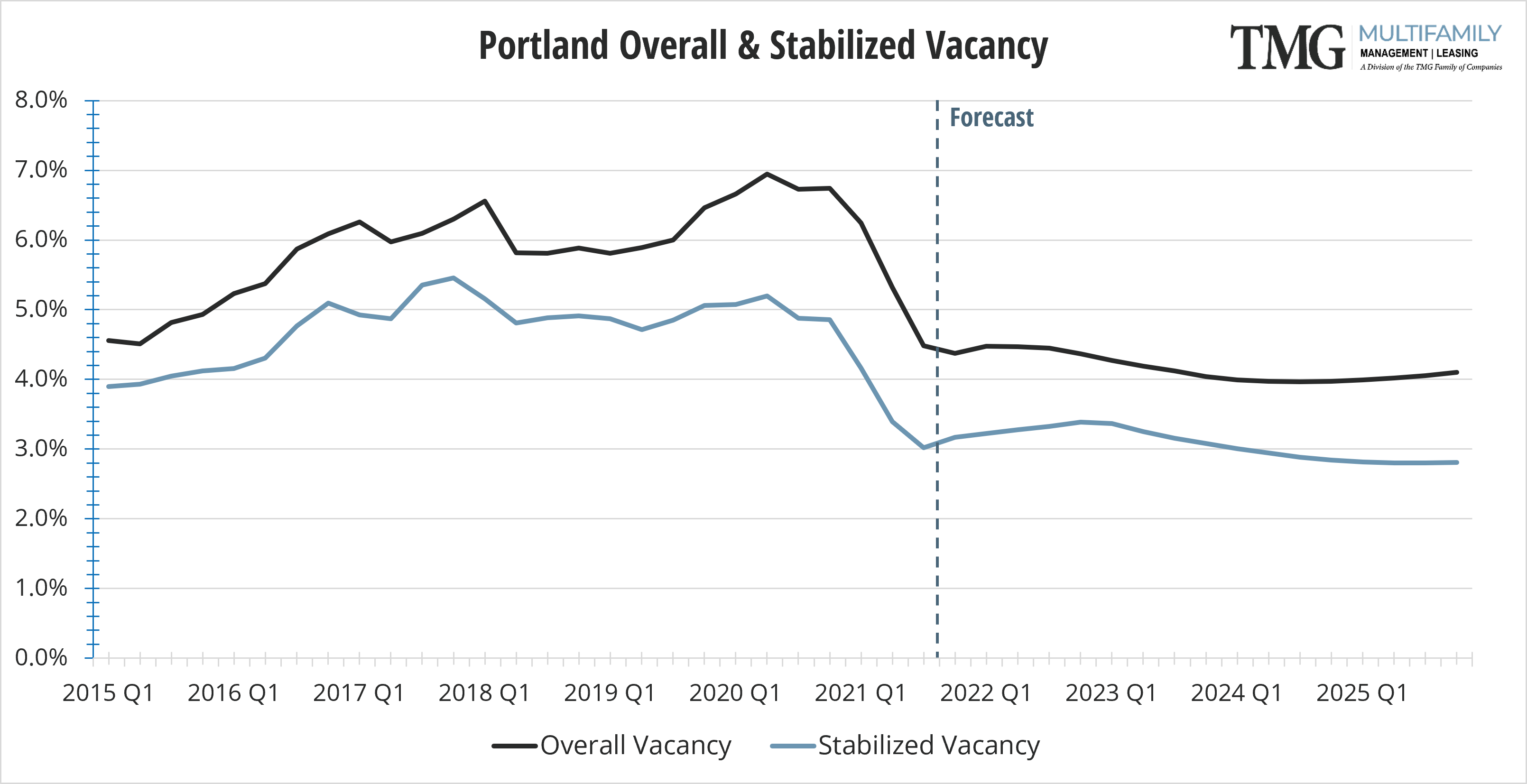

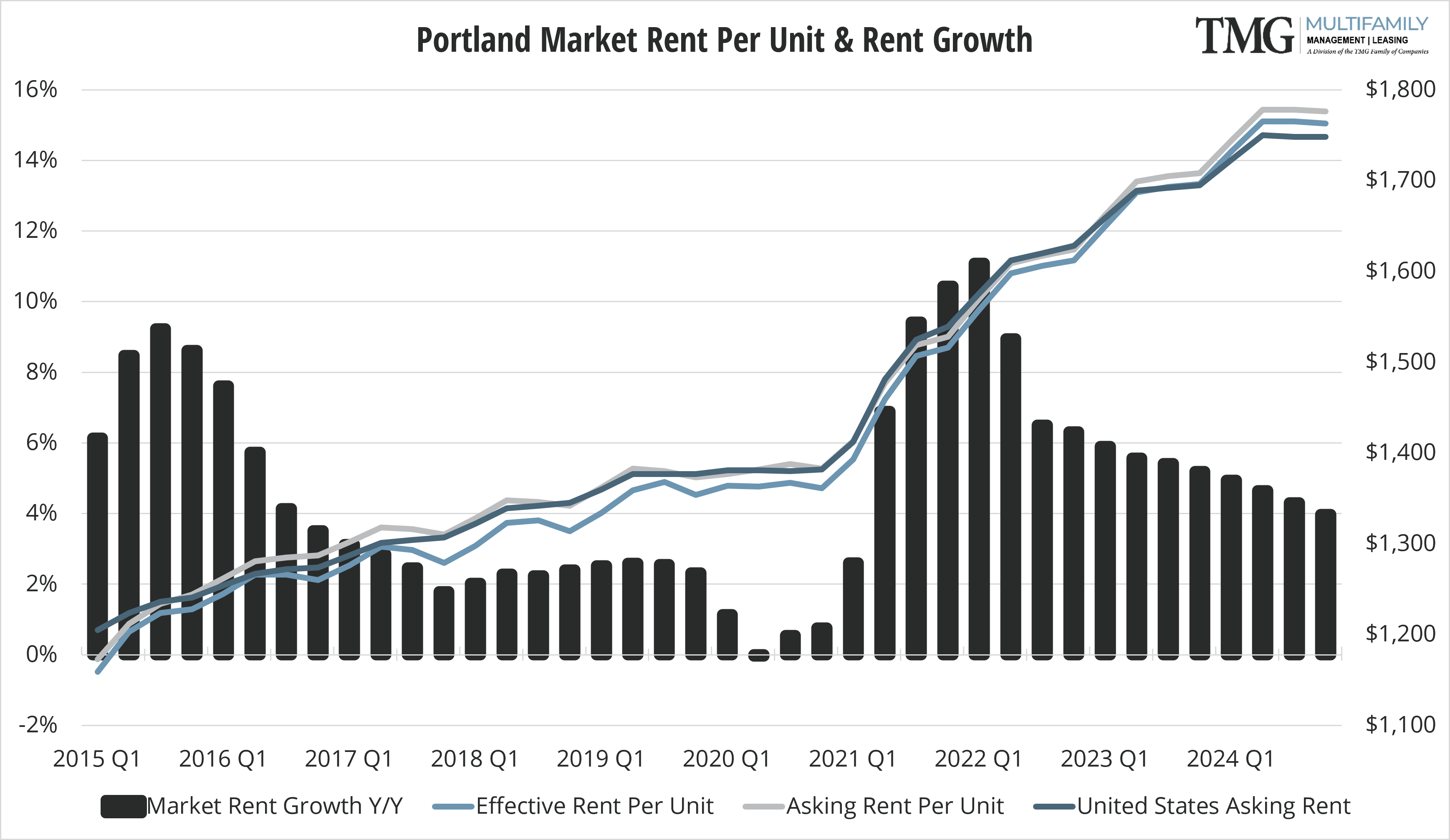

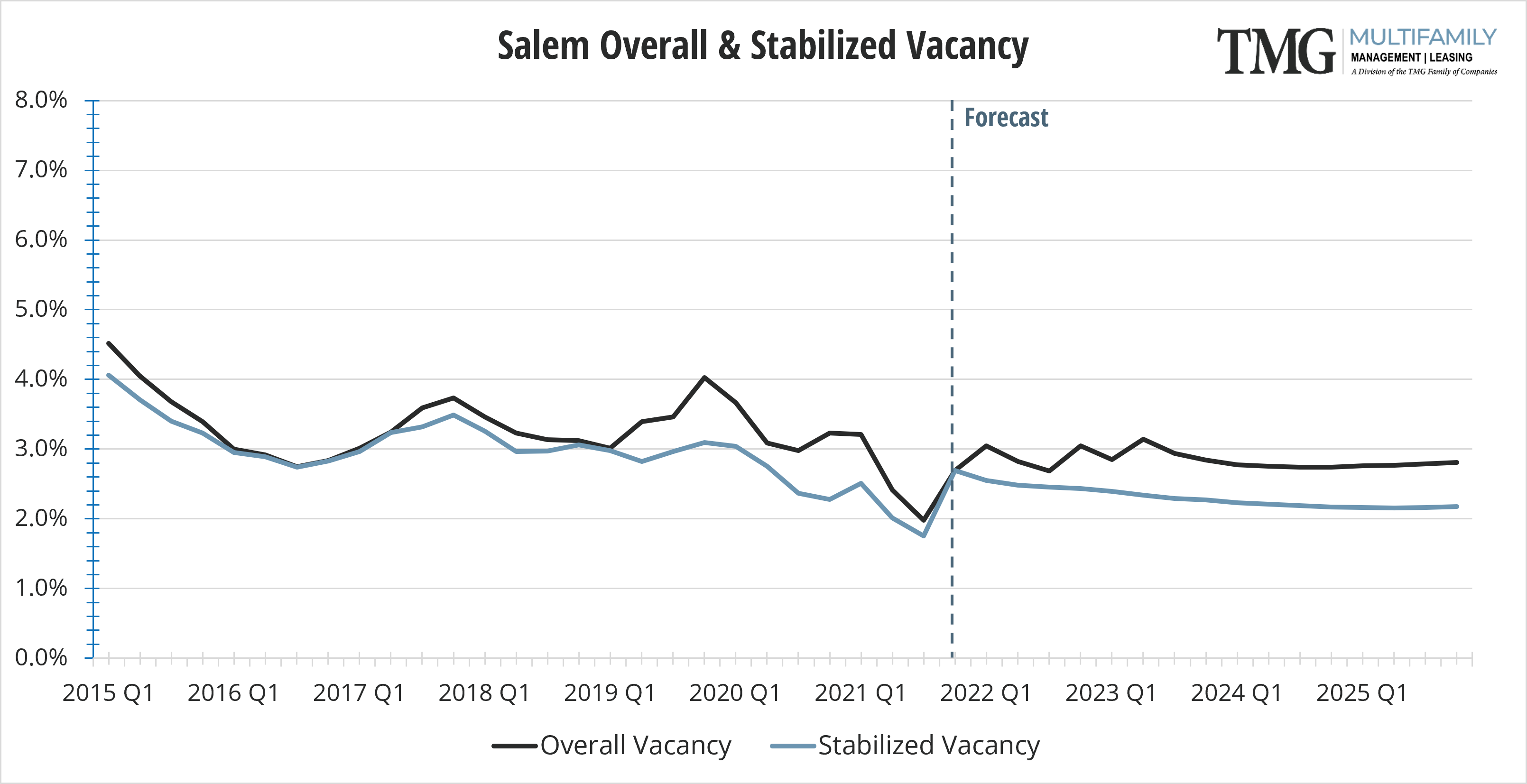

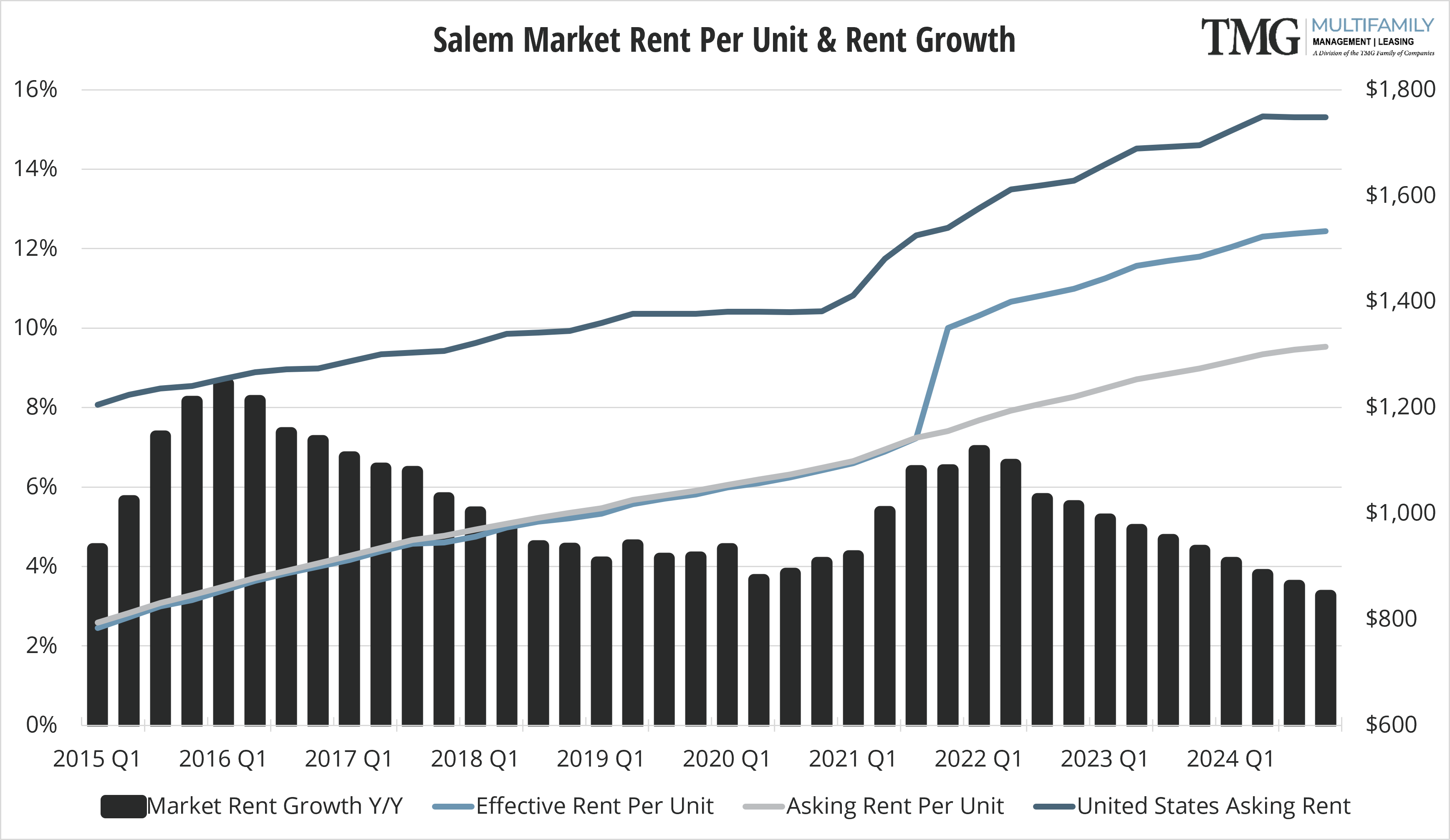

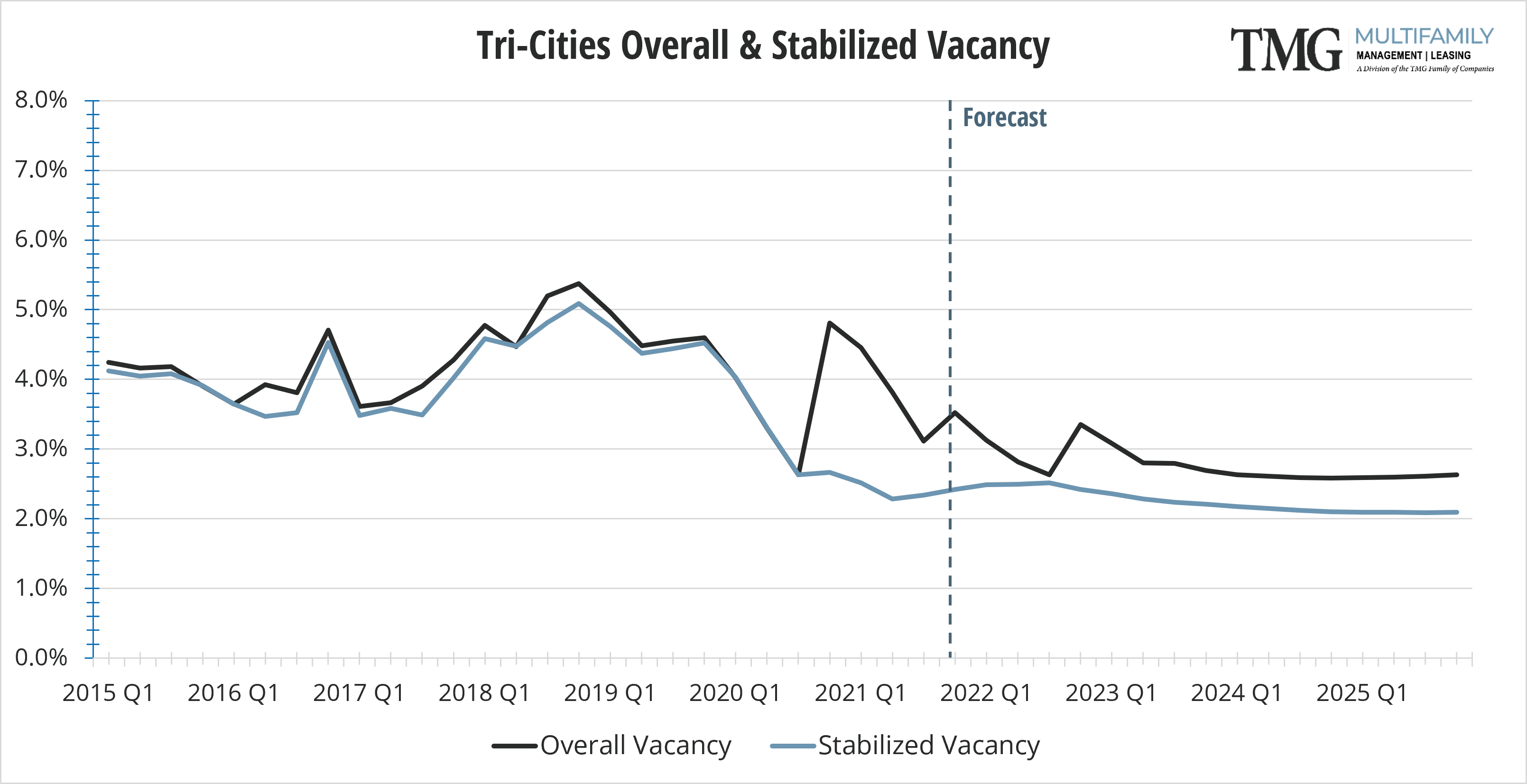

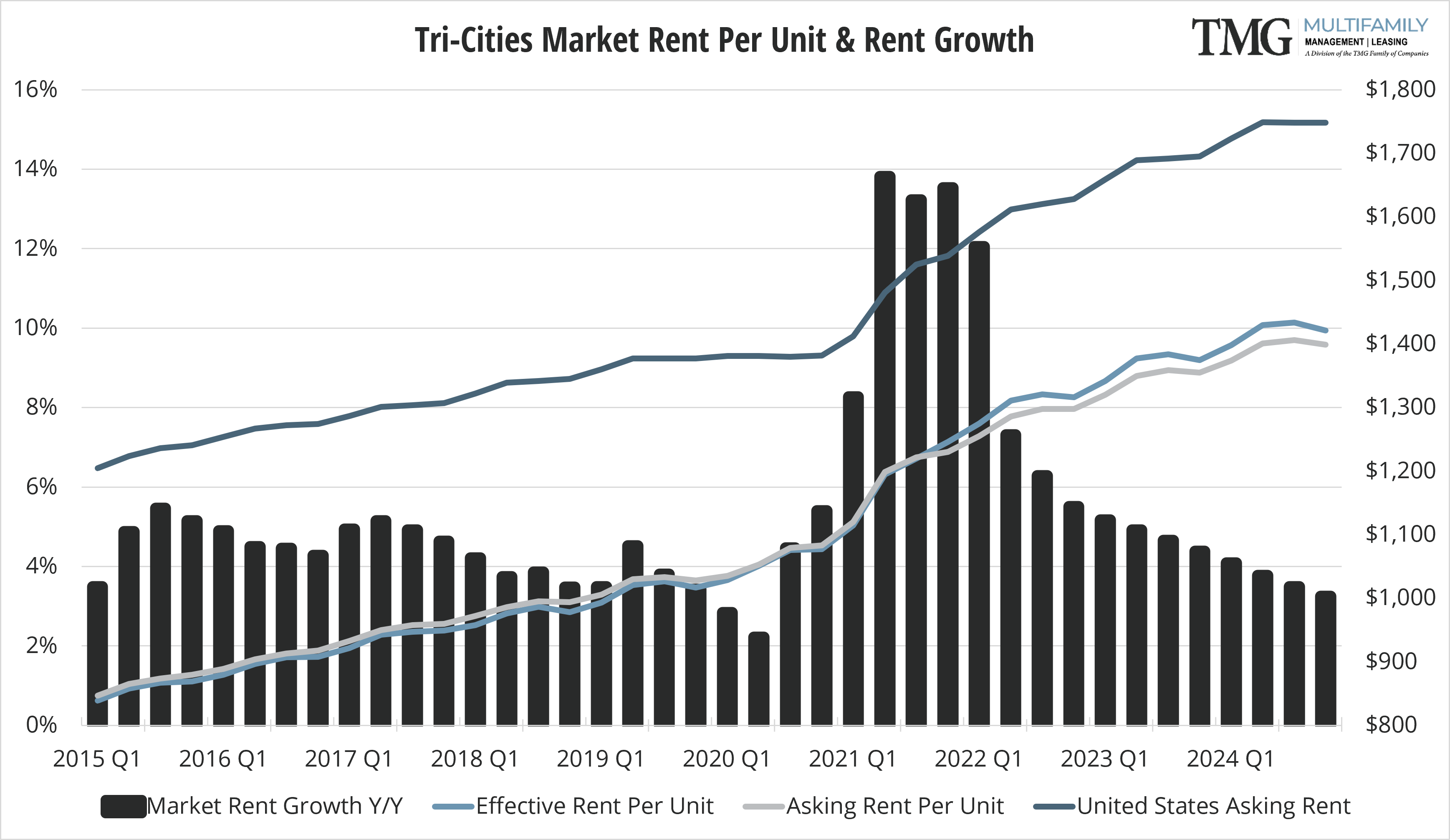

There is only good news for multifamily investors! While 2020 had a lulling effect at its start, it rebounded quickly in the second half of 2020 and has continued to gain momentum in nearly all markets. Class B & C properties stayed strong throughout 2020 & 2021 and Class A properties had notable gains in Q2 2021. Overall, Q2 rents in nearly all metro markets were higher than pre-COVID levels, and signs point to continued growth. Vacancy in many markets is at an all-time low even as new construction properties are coming on line at a steady pace. Net absorption is nearly 5x higher than this time last year and 4.5% above pre-COVID 2019 levels. Read below for specific submarket snapshots.

TRI-CITIESMultifamily

| 12 Mo. Delivered Units 507 | 12 Mo. Absorption Units 461 | Vacancy Rate 3.0% | 12 Mo. Asking Rent Growth 13.7% |

On August 26, 2021, the US Supreme Court struck down the CDC’s federal eviction moratorium, declaring it unconstitutional. Any landlords who had cases on hold due solely to a receipt of a CDC declaration may now proceed with termination of tenancy due to non-payment.

Oregon: Oregon’s Eviction Moratorium ended on June 30, 2021. Regular rent payments resume on July 1, 2021, unless tenants can show documentation that they have applied for rental assistance. Proof of incoming rental assistance may award tenants 60 days before eviction action can be taken on a current non-payment balance. Additionally, in May 2021, a bill passed in Oregon extending the grace period for repayment of rent balances to February 28, 2022.

Washington: Washington’s Eviction Moratorium ended on June 30, 2021. In June 2021, Washington announced a “bridge” proclamation between the eviction moratorium and the housing stability programs, effective July 1, 2021 through September 30, 2021. Beginning August 1, 2021, renters are expected to pay full rent, reduced rent negotiated with landlord, or actively seek rental assistance funding. Landlords may only evict a tenant if none of those actions are being taken, but must offer the tenant a reasonable re-payment plan before beginning the eviction process.

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar