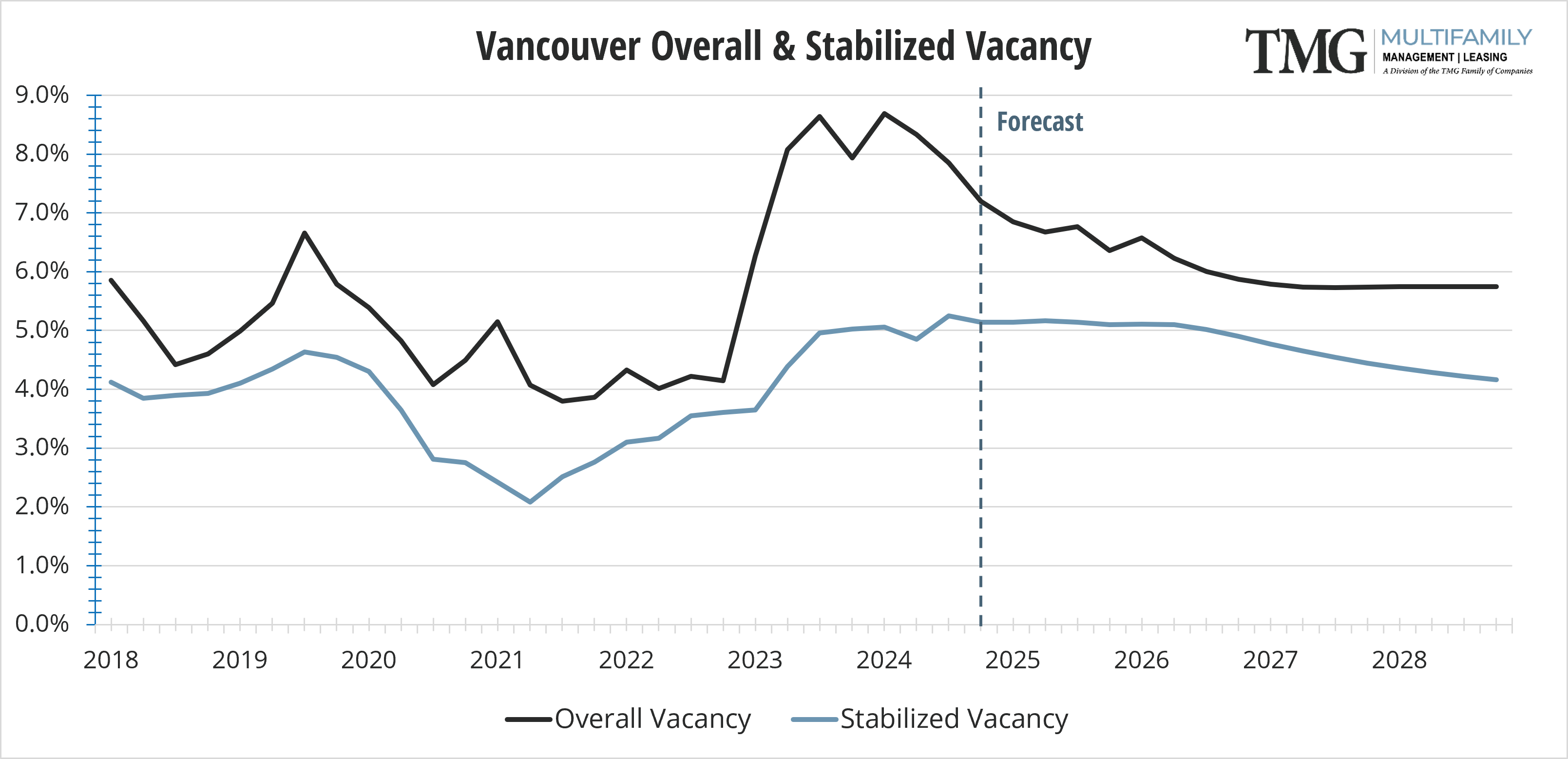

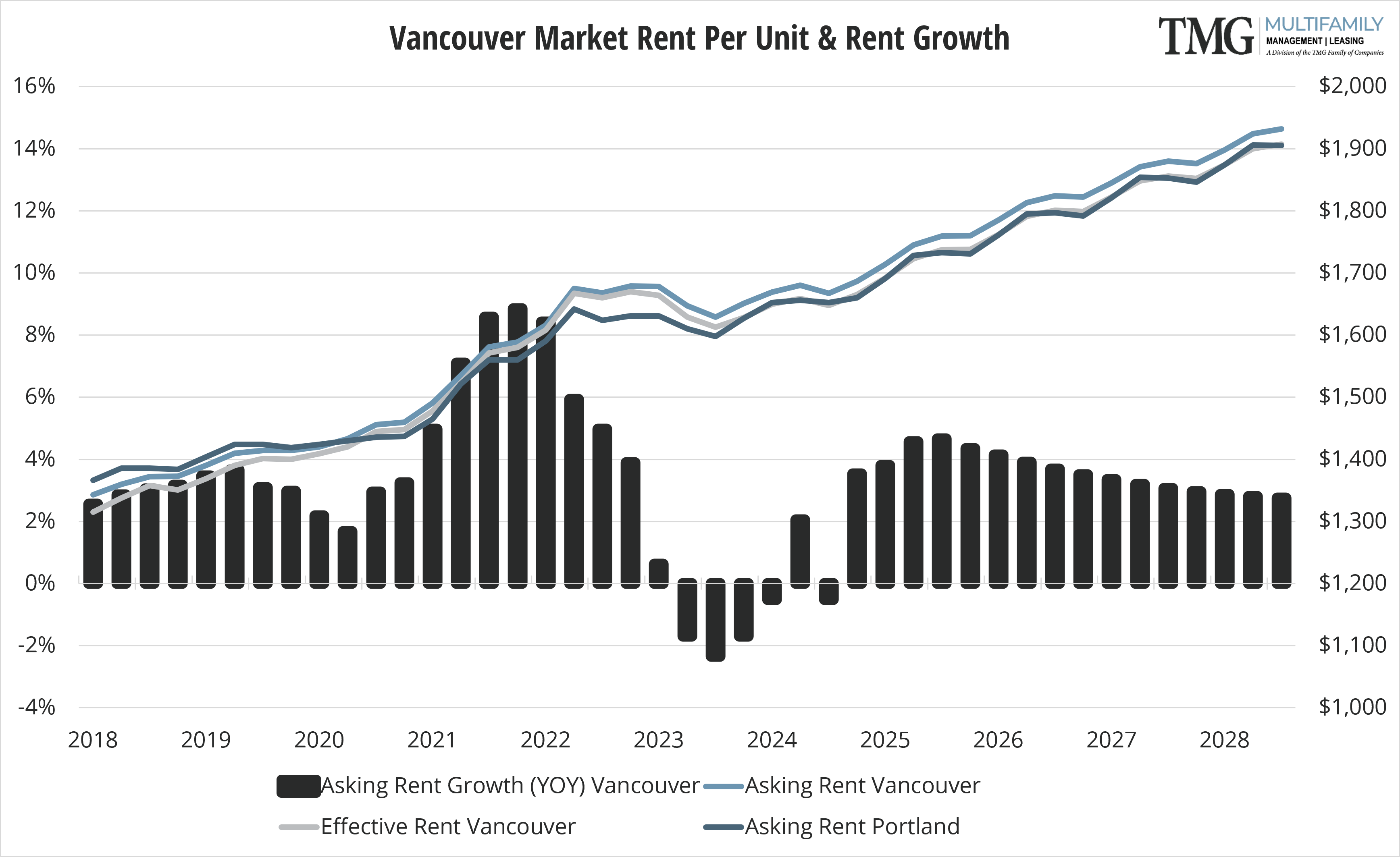

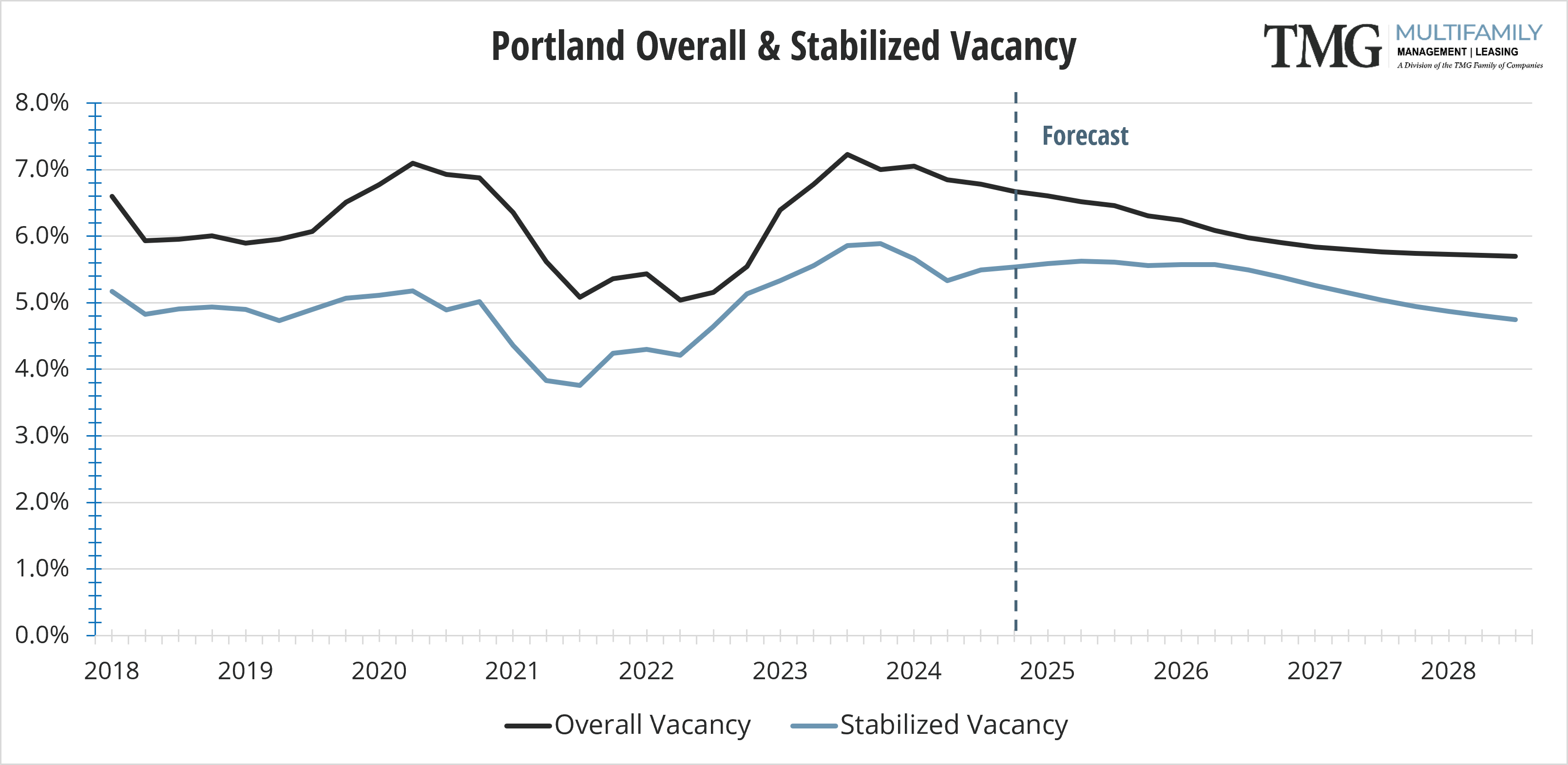

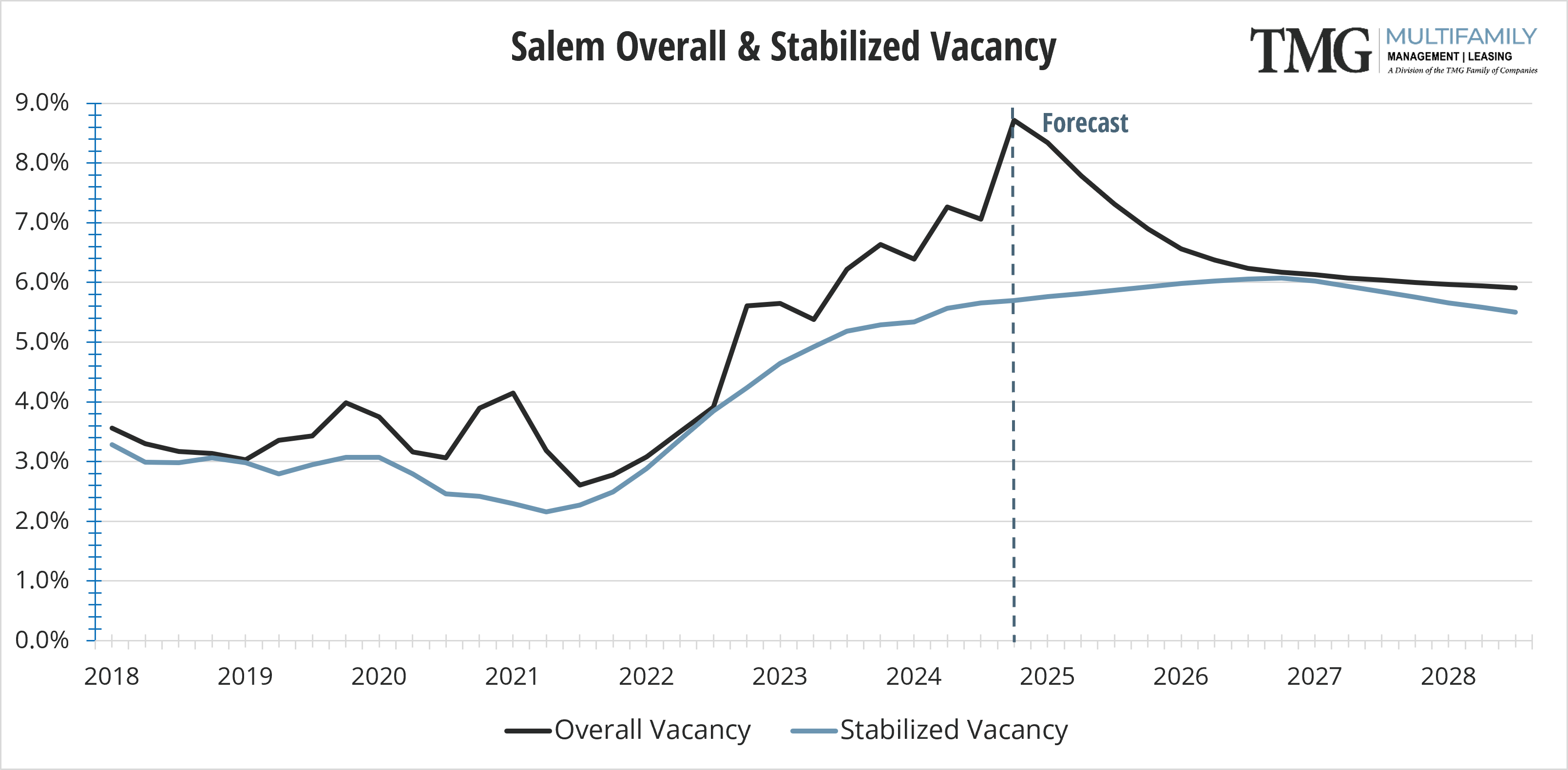

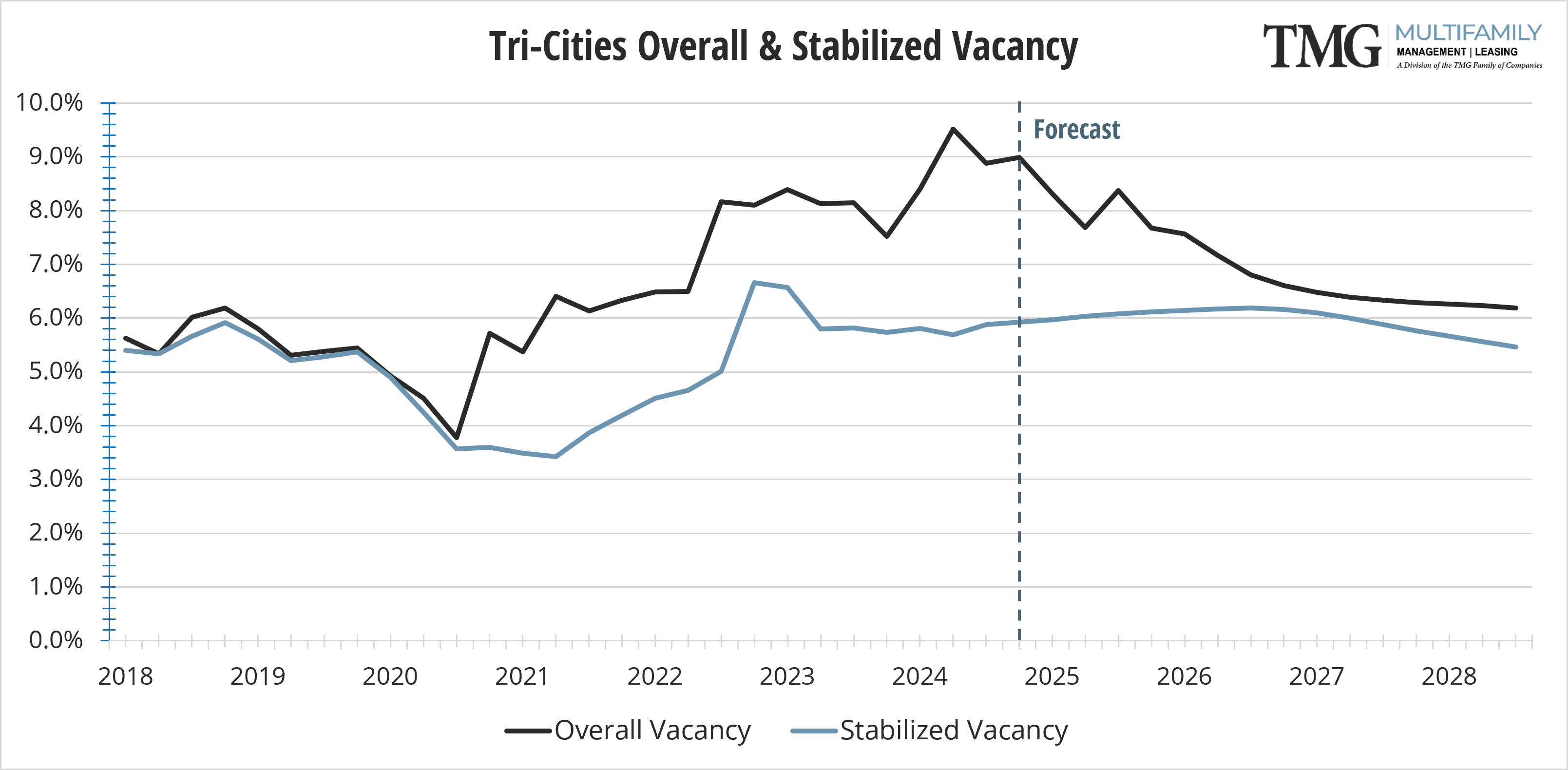

At first glance, the vacancy numbers for Q2 are a bit shocking! As you dig deeper into the reports for all markets, there are reasons behind those numbers. Once parsed out, they show a more positive path forward for lower vacancies and higher rent growth (albeit slower than 2022-2023) in Vancouver, Portland, Salem, and Tri-Cities.

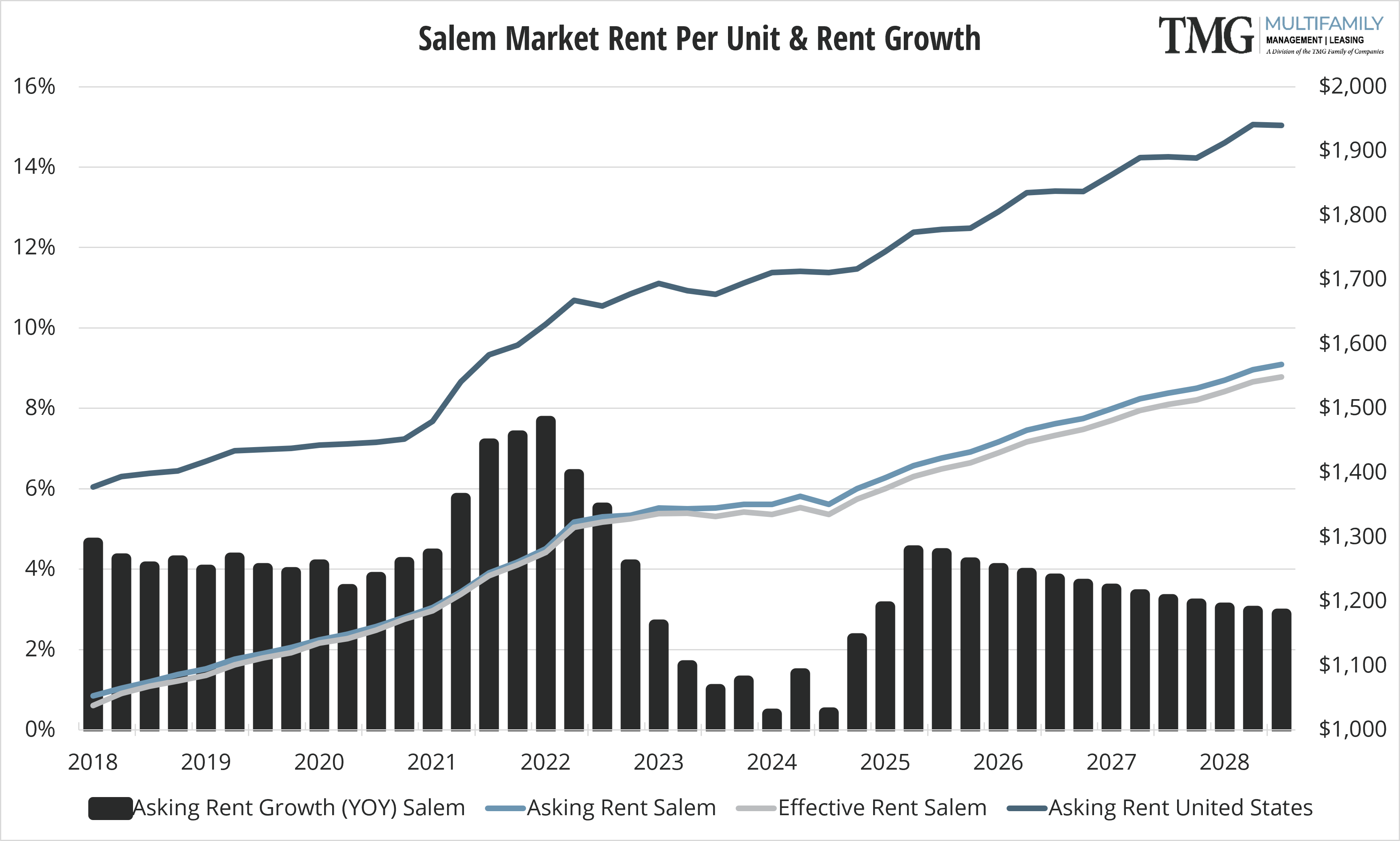

Portland had an 11% increase in delivered units from Q1 to Q2 and a 34% increase in absorption for the same period. Vancouver had a 4% increase in delivered units and a 19% increase in absorption. Salem exhibited the largest increase in delivered units over Q1 with an increase of 49% and an absorption of 42%. Tri-Cities had a 43% increase in delivered units with a 12% increase in absorption. It is notable that Pasco makes up 540 of the newly delivered units for Tri-Cities and more in that area are proposed.

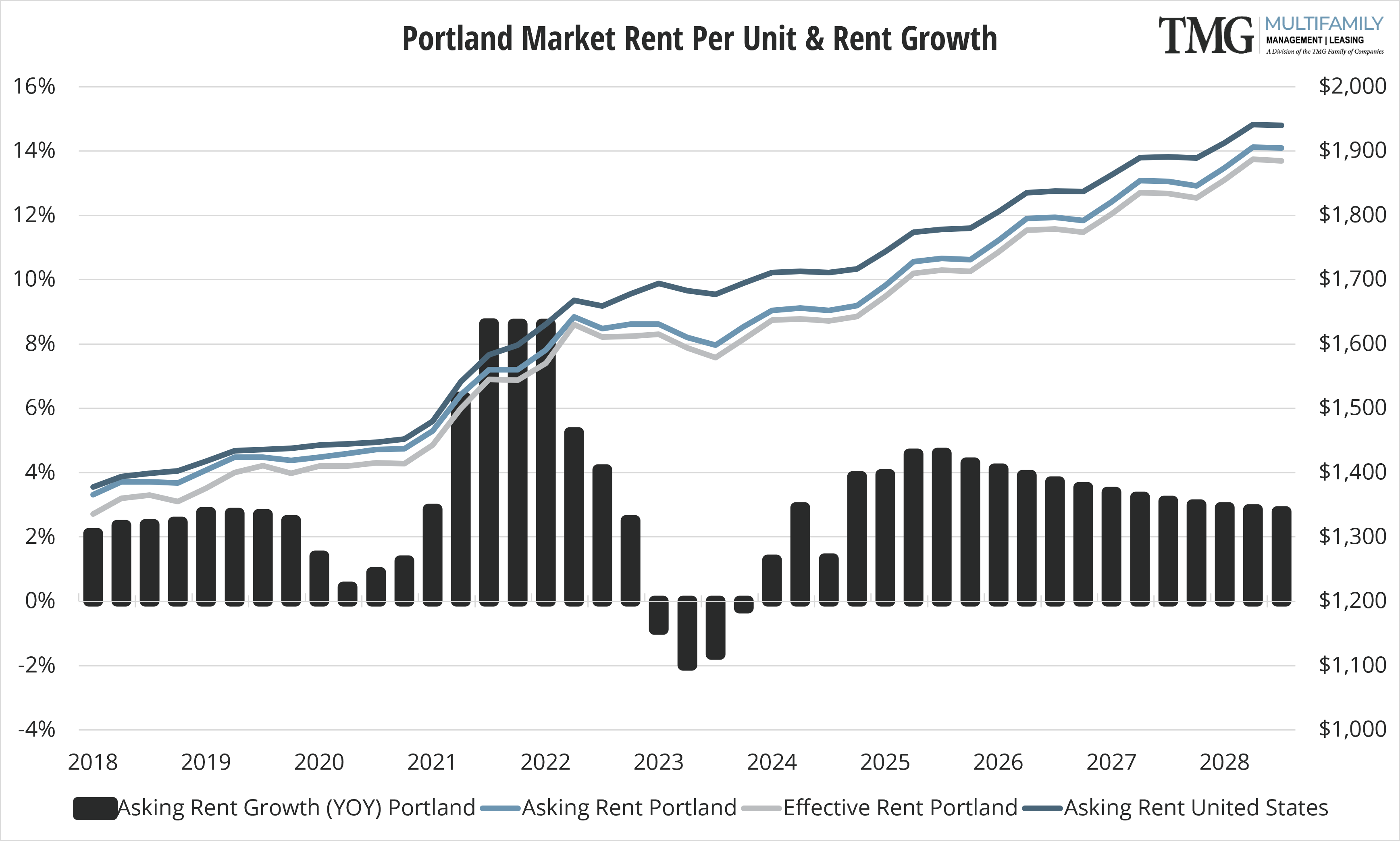

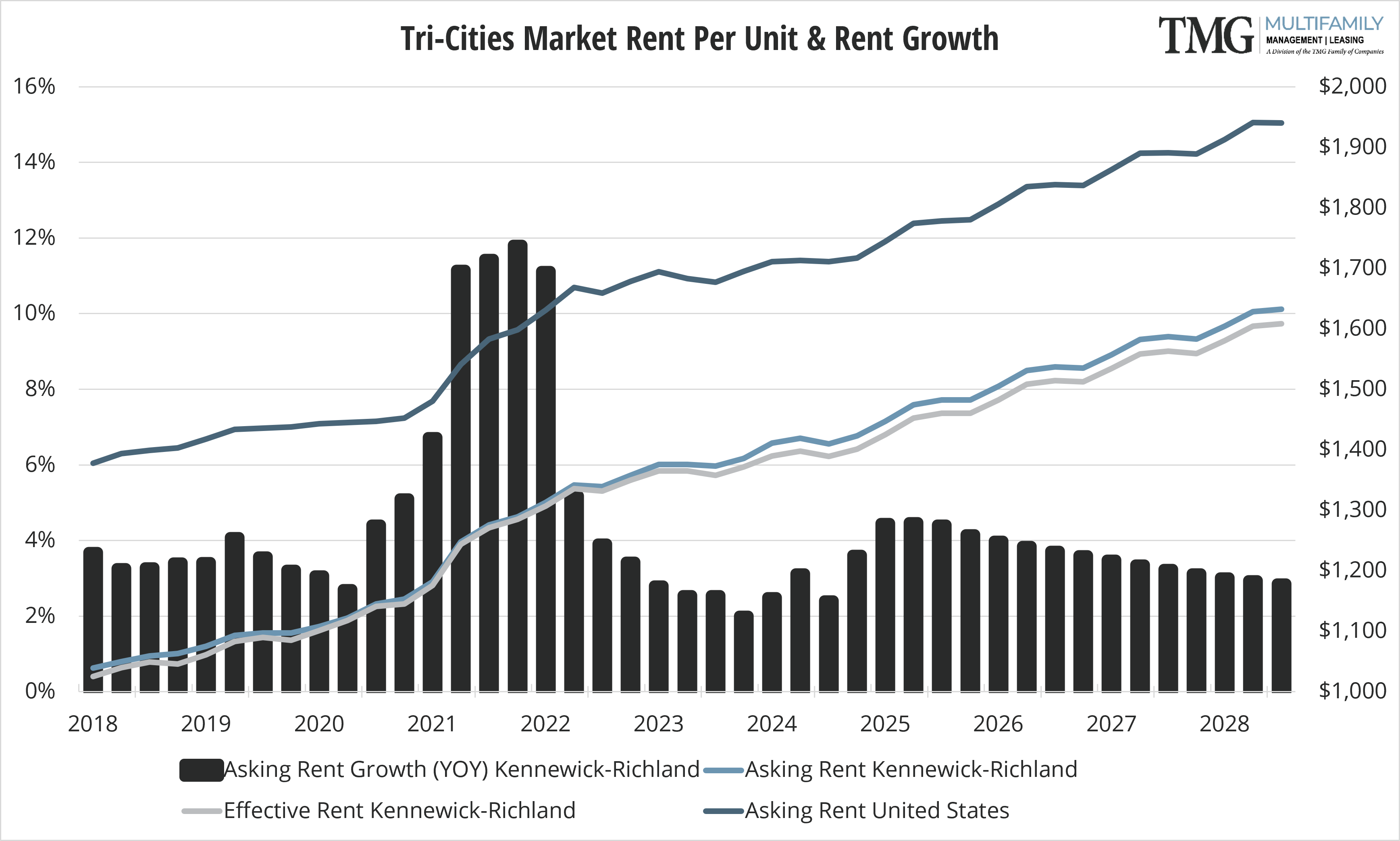

All markets except Vancouver are in positive asking rent growth with Tri-Cities leading at 2.4%. Vancouver is one of the PNW markets that has continuously shown increased population growth as well as apartment inventory that trends towards luxury, specifically at the Vancouver Waterfront. Vancouver will likely exhibit a positive asking rent growth in Q3 as the summer leasing season heats up. Vancouver’s average rent increased from $1,620 in Q1 2024 to $1,670 in Q2 2024 and is slightly higher than Portland Metro.

Concessions are still prevalent and have increased in both the number of properties offering concessions as well as the dollar amounts of those concessions. The industry standard of offering a 1 month rent concession for properties in lease-up is still going strong and many have stretched that to 2 months. The number of lease-ups offering concessions has prompted some stabilized properties to do the same, especially those that are in locations with multiple new lease-ups. However, the concession amounts for stabilized properties appear to be limited to “specials” and are less than 1 month’s rent.

Delinquencies were up slightly in all markets in June 2024 over May 2024. However, Q1 2024 had higher delinquent amounts overall than Q2 2024. As the economy battles inflation, we may see a continuing uptick in delinquencies.

Properties are getting no relief from increasing expenses. Property taxes, insurance, replacements for carpet, LVT, and products like doors, paint and general supplies have all increased. This is in addition to the increased onsite wages that began a fast trajectory in 2020 and continue, although onsite wages are leveling out in tandem with overall employment numbers.

While current vacancy rates may seem high, the projected decrease in delivered units for late 2024 and 2025 should increase demand overall, reducing vacancy rates. Class A units in some markets may be negatively affected if the home sales market catches fire later this year.