| Q1 • 2025 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

Market Trends 2025: Renewals Surge, Supply Tightens, and Regional Markets Show Divergence

As we move deeper into 2025, the rental market is experiencing a notable shift: renters are choosing to stay put. According to a recent RentCafe report, lease renewals have reached an all-time high, with more than 63% of renters opting not to move—further tightening an already constrained rental market. National apartment occupancy remains high at 93.3%, indicating limited turnover and increasing demand for available units.

In all four markets we cover, the year started with lower-than-usual leasing traffic—a trend that typically begins to shift in February. However, 2025 has seen a delayed rebound, with significant activity only beginning to ramp up in April.

Market Highlights: Vancouver and Tri-Cities Lead

Among the four key markets tracked—Vancouver, Portland, Salem, and Tri-Cities—Vancouver and Tri-Cities have emerged as leaders. Both regions are benefitting from sustained immigration: Vancouver continues to attract residents relocating from Portland, while Tri-Cities is drawing demand from Seattle and other cities in northern Washington. In both areas, job growth is following population trends, further reinforcing demand for rental housing.

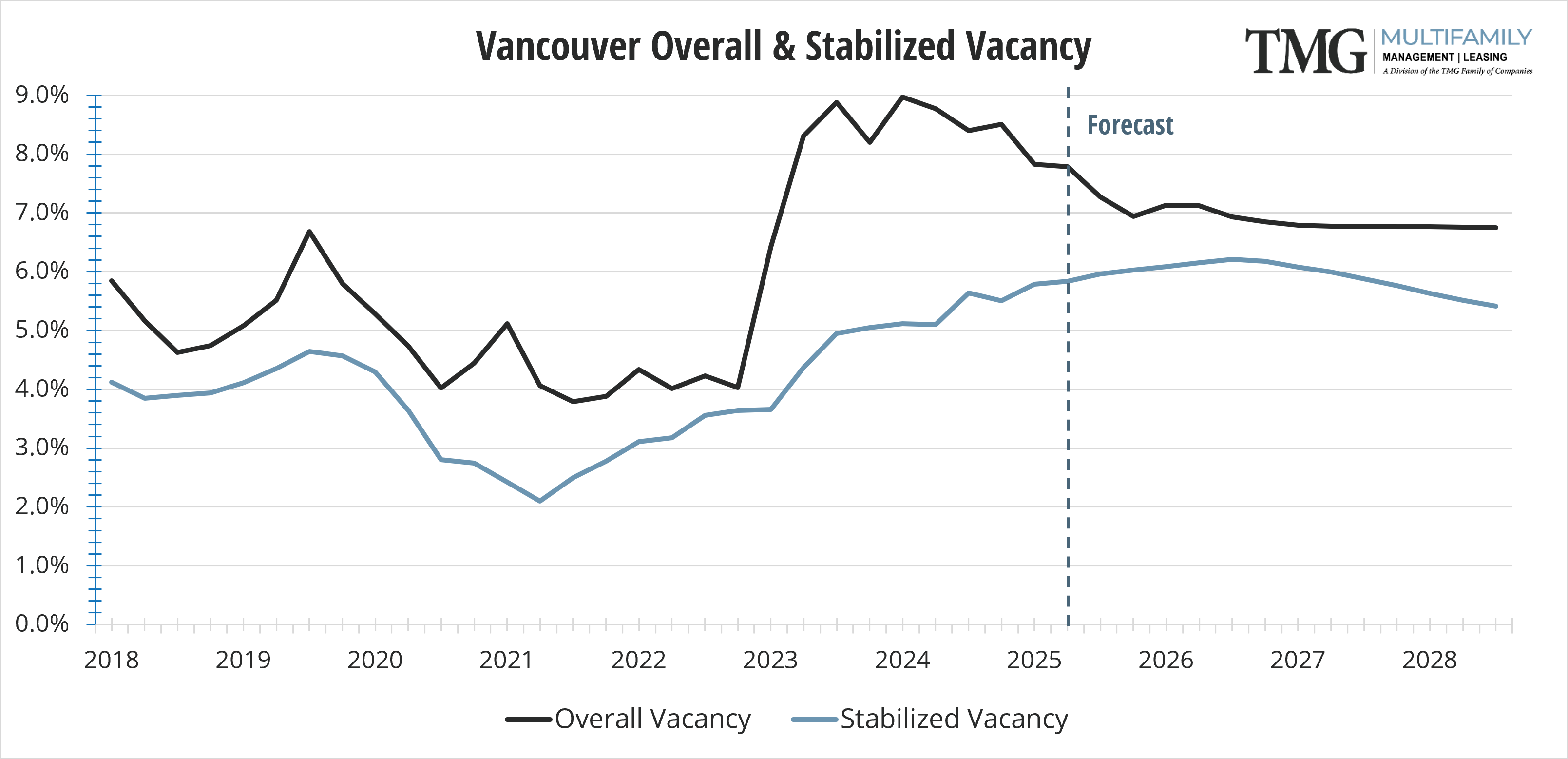

Vancouver saw rent growth ease from 1.6% last quarter to 0.9% in Q1 2025, while its vacancy rate remained steady at 7.8%. Average rent at $1700 has again surpassed Portland’s average of $1670.

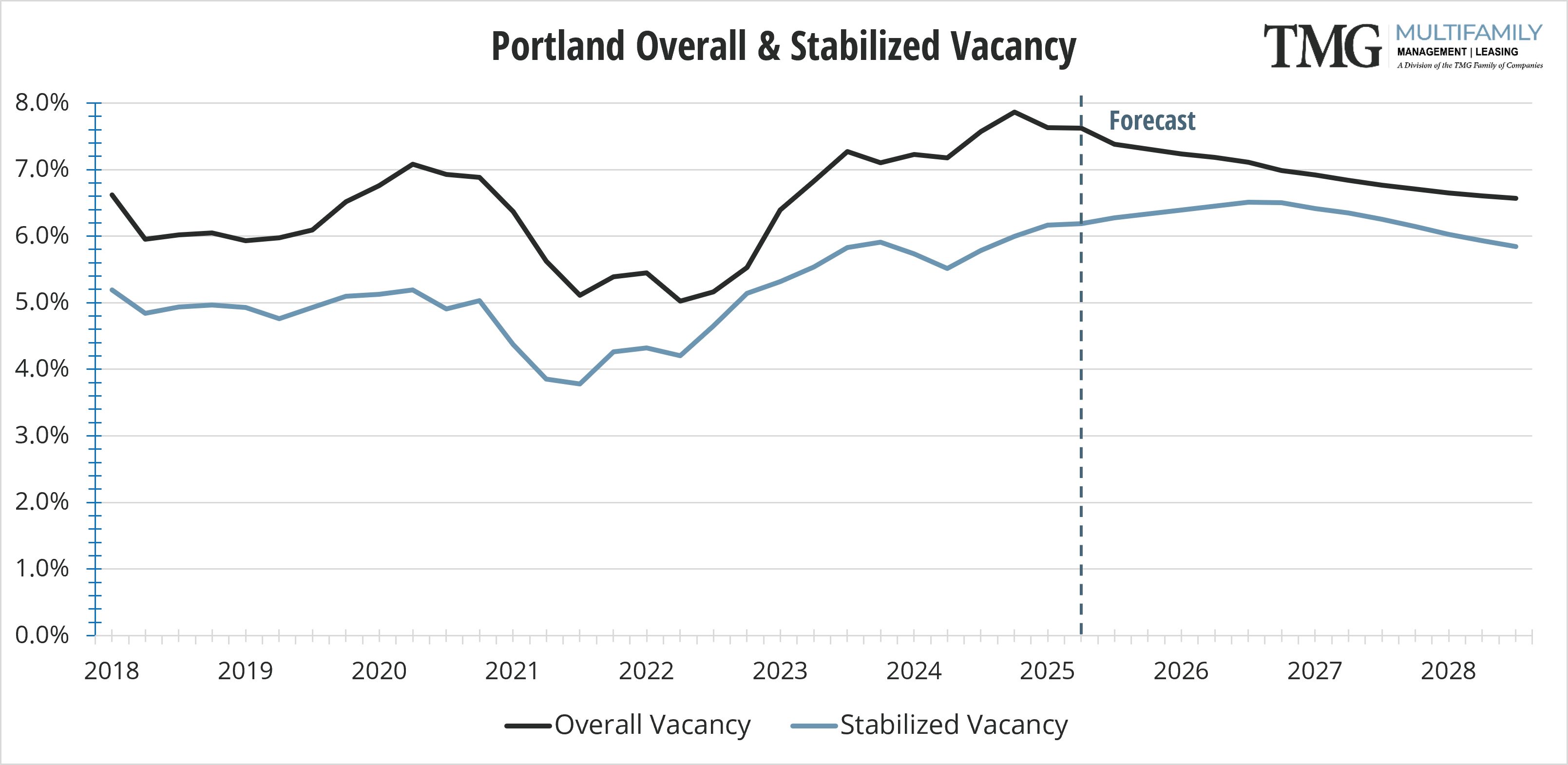

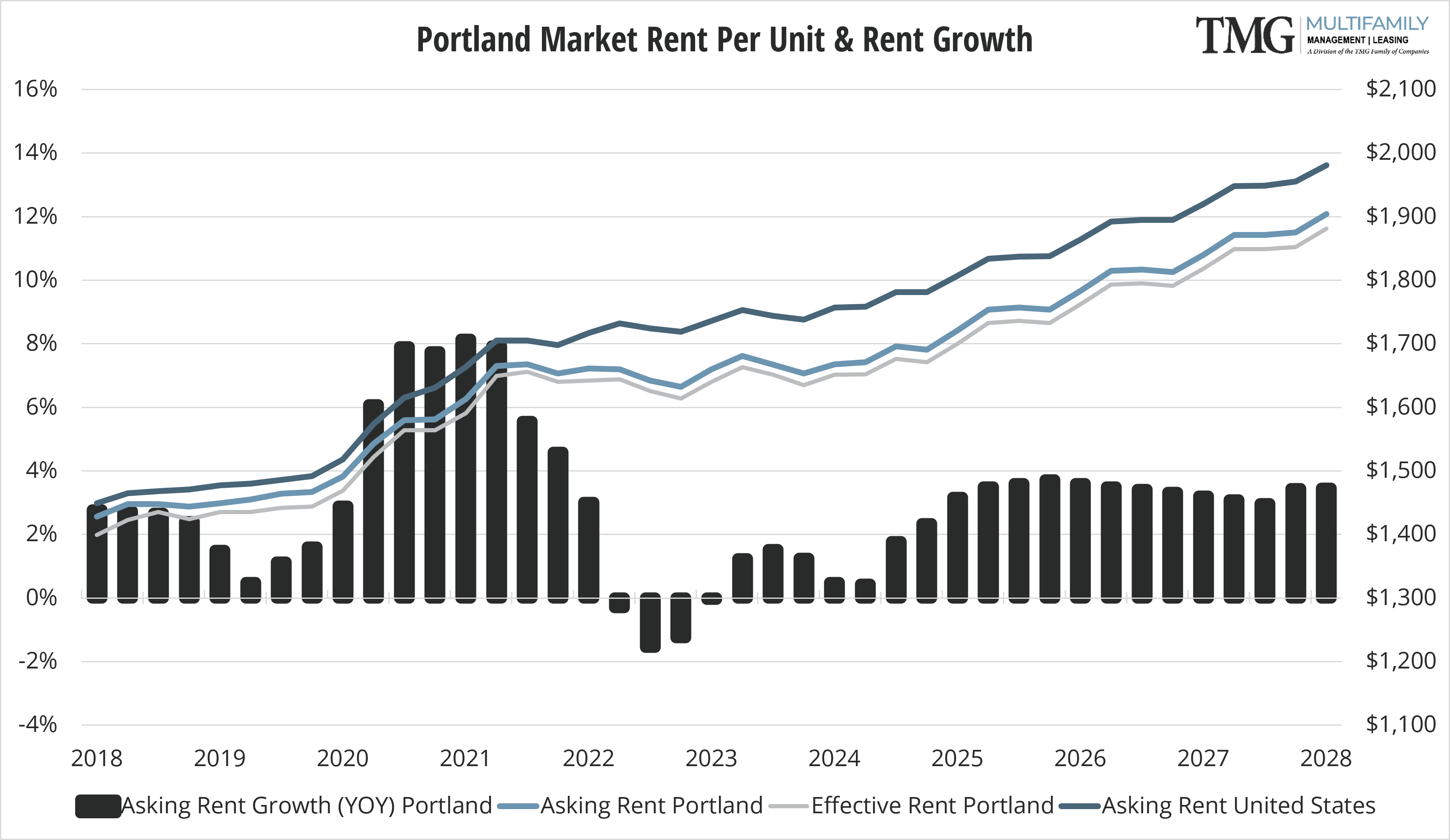

Portland mirrored this pattern, with a similar dip in rent growth and a slight uptick in vacancy. According to Multifamily Northwest’s Spring apartment report, the best-performing market in terms of occupancy is Hillsboro (North of Hwy 26), which saw its vacancy rate drop from 5.82% to 4.92%, reflecting a 15.46% improvement. In contrast, Aloha experienced the largest increase in vacancy rates, rising from 4.94% to 6.01%, a 21.66% jump.

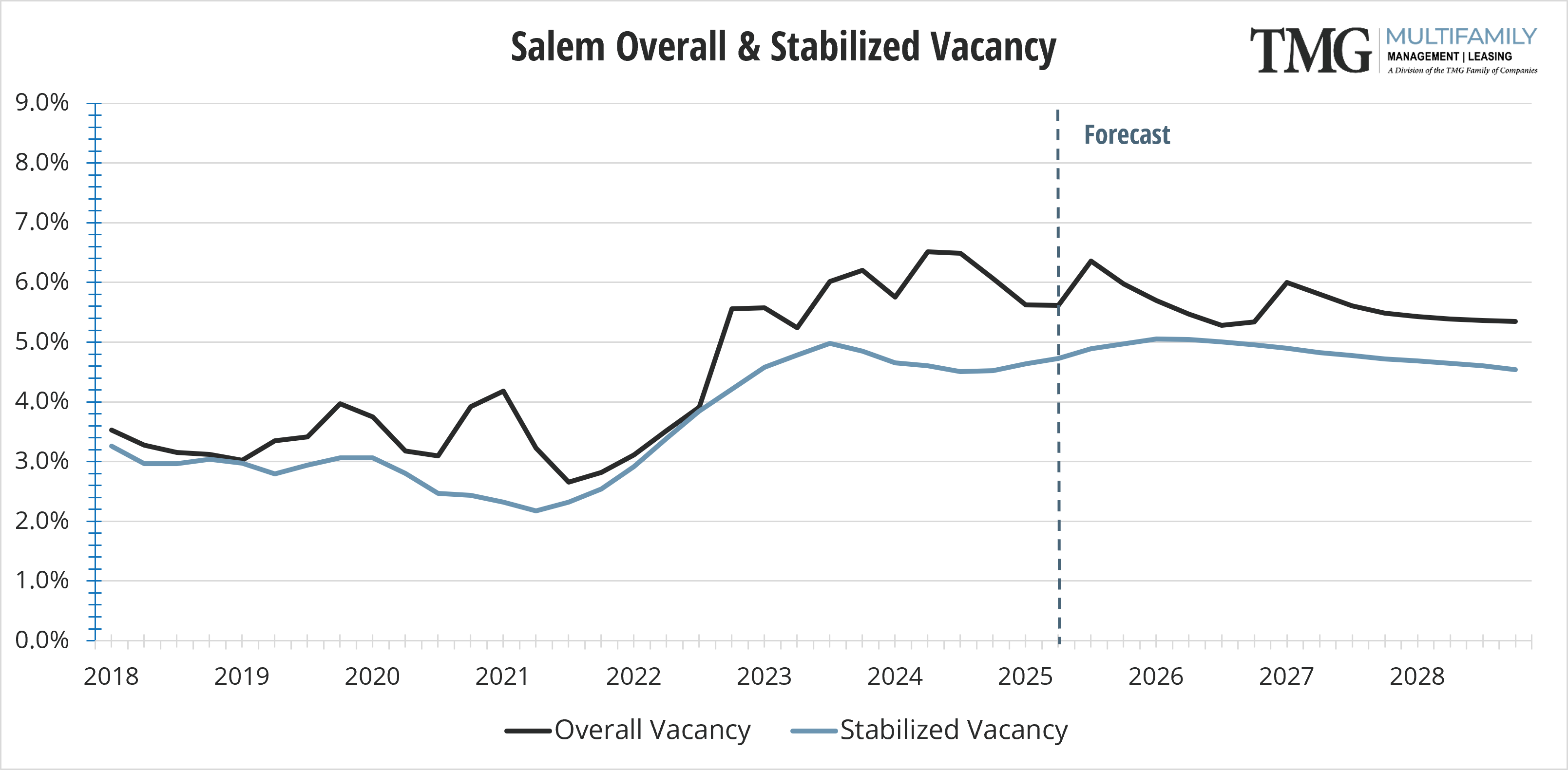

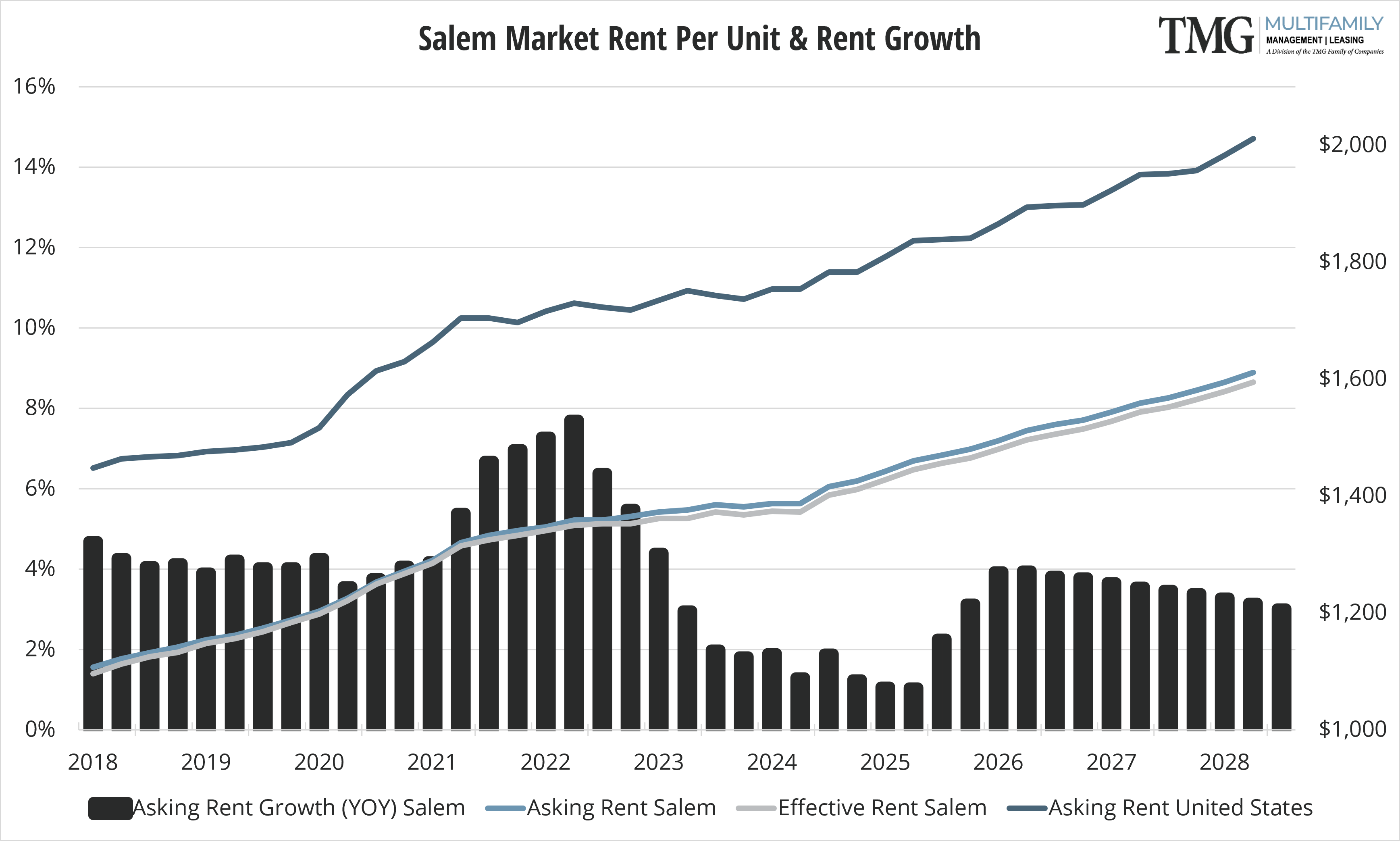

Salem, by contrast, continues to post the lowest vacancy rate among the four markets at 5.6%—a trend that has held steady through Q1 2025. Rent growth in Salem reached 1.3%, placing it just behind Tri-Cities.

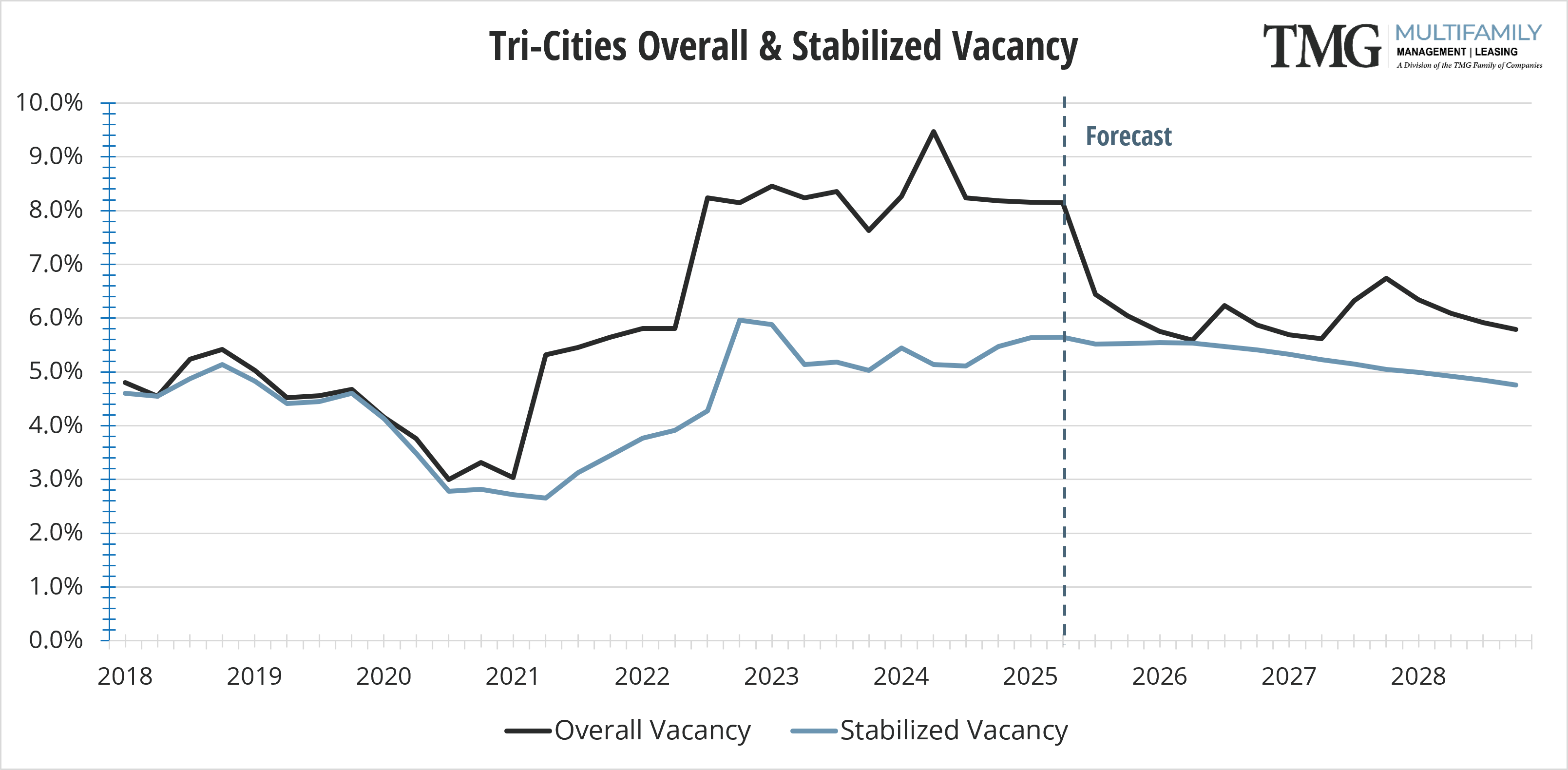

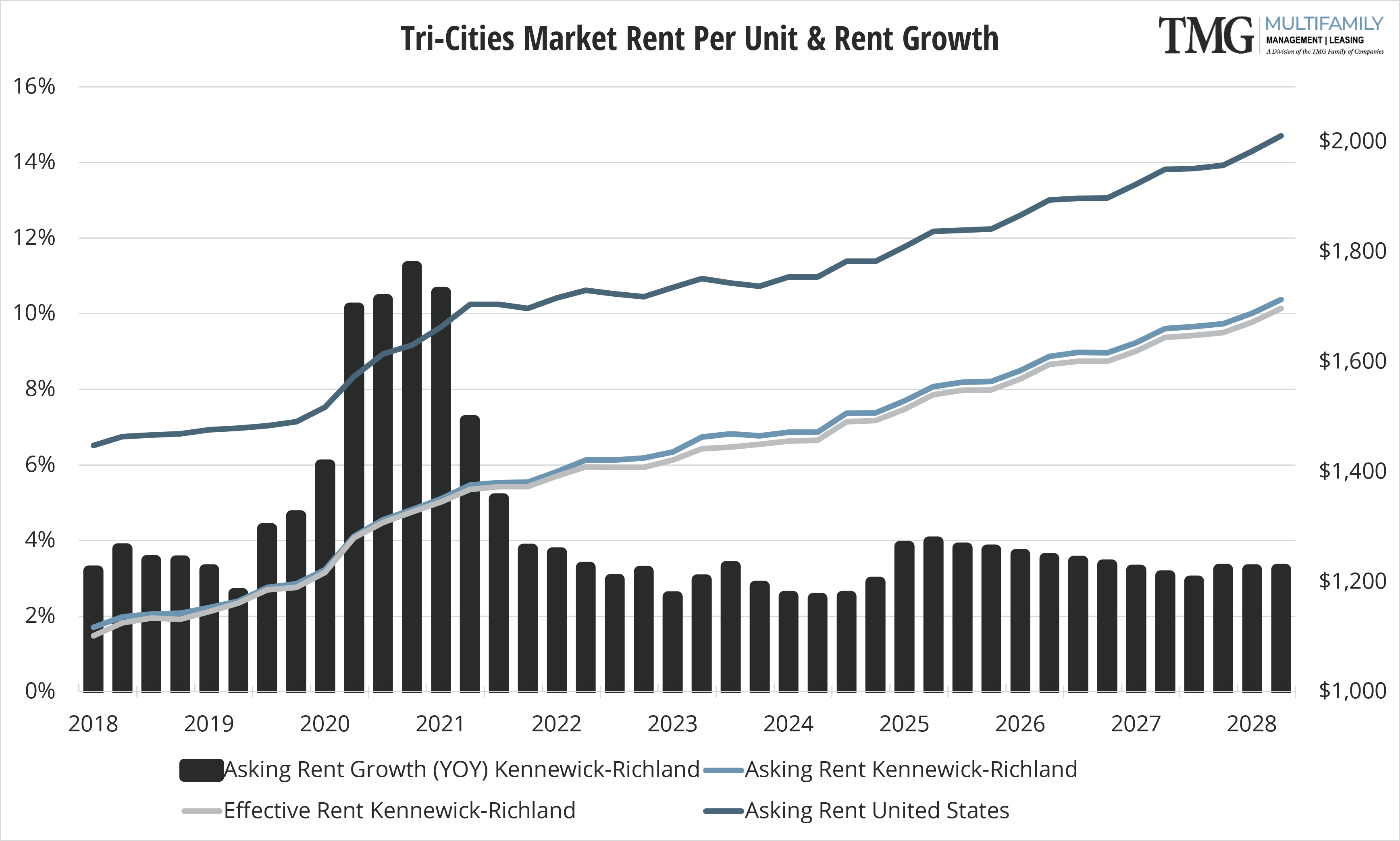

Tri-Cities stands out with the strongest performance for rent growth, recording a 2.5% rent growth rate for Q1 2025. The region’s momentum is fueled by both job creation and new resident inflow. A notable slowdown in new housing deliveries supports continued rent growth projected to exceed 4% over the coming year. While other areas in the Pacific Northwest have experienced disruptions due to federal layoffs, Tri-Cities’ primary employer—Hanford—has not issued any layoff notices to date, providing additional market stability.

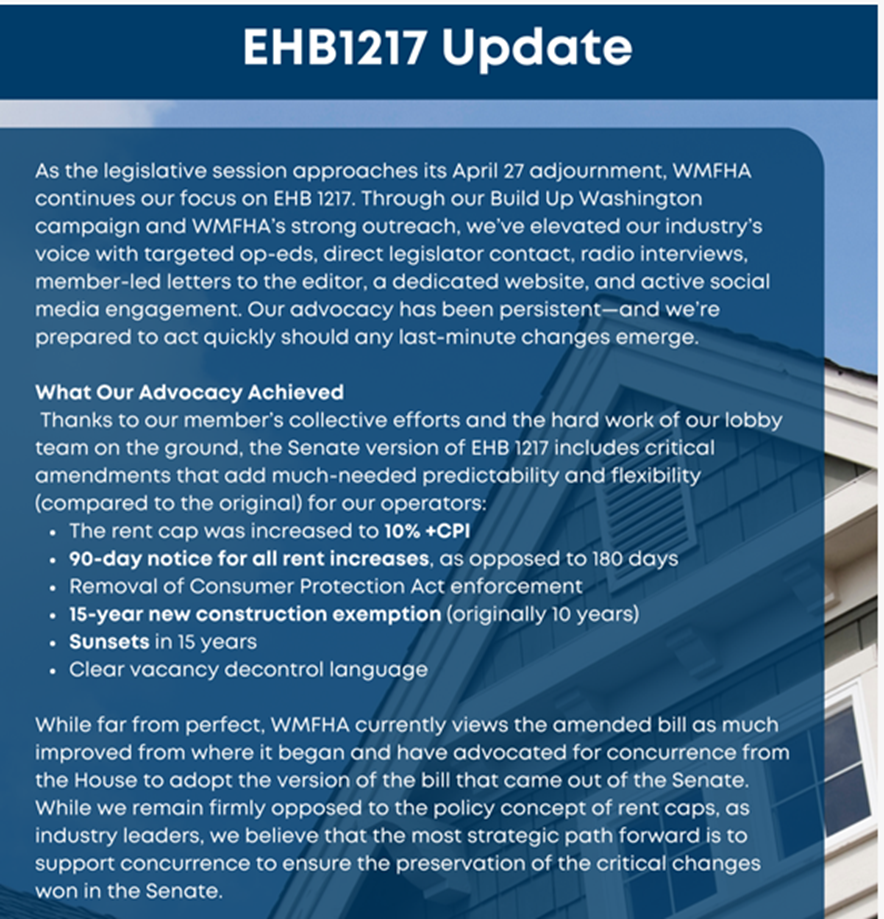

Rent Control in Washington

Washington State continues to see active legislative discussions around rent control. As of April 23, 2025, proposals remain under review, with the most prominent consideration being a cap on annual rent increases. While rent control measures are generally met with concern by property owners, the proposed 10% cap is considered manageable by many landlords in practical terms. To the right is an update from the Washington Multifamily Housing Association.

The TMG Multifamily Quarterly Market Pulse is brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals since 1985.

CARMEN VILLARMA, CPM

President

The Management Group, Inc.

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

Portland Metro

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

Salem

698 12th St SE Ste 240

Salem OR 97301

Tri-Cities

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar.